Talking Points

- USD/JPY targeting near-term resistance ahead of NFPs- Key range in focus

- Check out our 2Q USD/JPY projections in our Free DailyFX Trading Forecasts.

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Technical Outlook:USDJPY is trading just below slope resistance into the start of June trade and heading into U.S. Non-Farm Payrolls tomorrow, the focus is on the weekly opening-range which has taken shape just below. The broader risk is weighted to the downside while below this slope with a breach above 112.20 needed to invalidate the short-side bias. A break lower targets the 200-day moving average backed by 109.45/60.

USD/JPY 240min

Notes: A closer look at price action highlight near-term resistance at the indicated region just above 111.45 with key near-term support seen at the 61.8% retracement of the mid-April advance at 110.51- Look for a break of this range for guidance.

From a trading standpoint, I’ll favor fading strength while below resistance with a break of the weekly opening range lows to validate the next leg lower targeting 110.11 & the lower parallel at 109.47. A third of the daily average true range (ATR) yields profit targets of 23-26pips per scalp. Added caution is warranted heading into tomorrow’s U.S. labor report with the release likely to fuel increased volatility in the USD crosses.

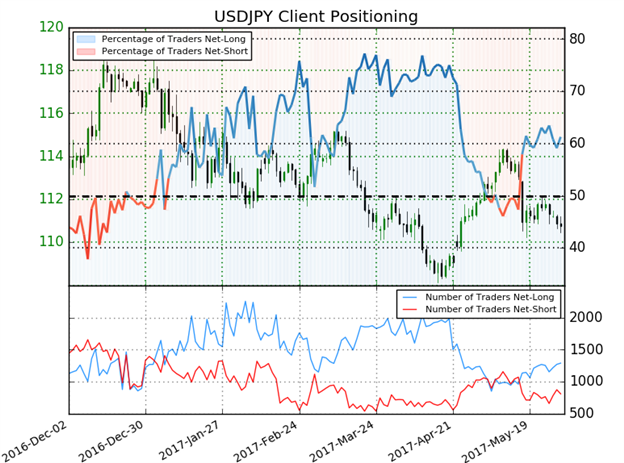

- A summary of IG Client Sentiment shows traders are net-long USD/JPY- the ratio stands at +1.58 (61.3% of traders are long)- bearish reading

- Retail has remained net-long since May 17 when USDJPY traded was trading at 112.80- price has moved 1.9% lower since then

- Long positions are 2.8% higher than yesterday but 7.3% lower from last week

- Short positions are 1.5% higher than yesterday and 2.4% higher from last week

- While broader sentiment continues to point lower, the recent build in short-positions suggests the immediate rebound may have more to go before turning over. That said, from at trading standpoint, I’ll still favor fading strength while below structural resistance.

See how shifts in USDJPY retail positioning are effecting market trends- Click here to learn more about IG Client Sentiment indicators!

---

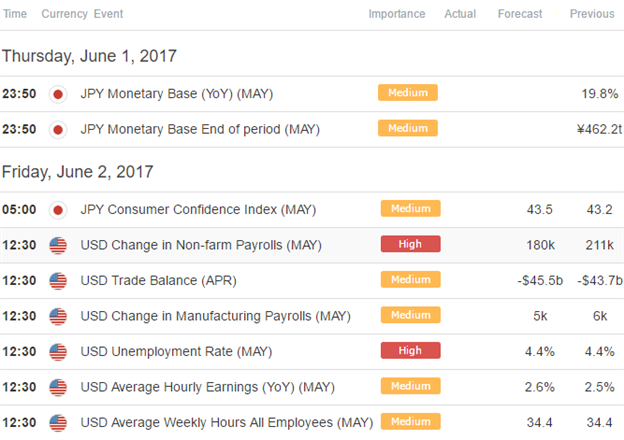

Relevant Data Releases

Other Setups in Play:

- Cable Reversal Targets Monthly Open Ahead of NFPs, UK Elections

- Gold, Silver Prices Reach for Resistance

- Kiwi Flies Towards Resistance

- USD/MXN: Wall of Resistance Holds, Now What?

- Crude Oil Prices Target Resistance Ahead of OPEC

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.