Talking Points

- USD/CAD Longs at risk ahead of key US/Canada data prints

- Updated targets & invalidation levels

- Looking for more trade ideas? Review DailyFX’s 2017 Trading Guides. Join Michael for Live Weekly Trading Webinars on Mondays at 13:30GMT (8:30ET)

USDCAD 120min

Technical Outlook:USDCAD is testing near-term channel resistance & heading into the close of the week the focus is against the 1.3430/50 zone. Initial support rests at 1.3360/70 backed by the monthly / weekly open at 1.3310. A break below Friday’s low at 1.3284 would be needed to mark a more meaningful reversal in the pair targeting 1.3252 & 1.3184.

A breach above the weekly range highs invalidates the reversal play with such a scenario targeting 1.3476, 1.3521 & a longer-term 50% retracement of the 2016 range at 1.3575. While we cannot rule out another test of the highs on a data spike tomorrow, from a trading standpoint I’ll favor fading strength while within this formation with a break of the weekly / monthly opening-range lows needed to keep the short-bias in focus.

A quarter of the daily average true range (ATR) yields profit targets of 20-24pips per scalp. Tomorrow’s economic docket is especially important for the Loonie with the U.S. Non-Farm Payrolls report (NFP) and Canada employment both on tap at 8:30ET in New York. Added caution is warranted heading into the release with the data likely to fuel increased volatility in both respective currencies.

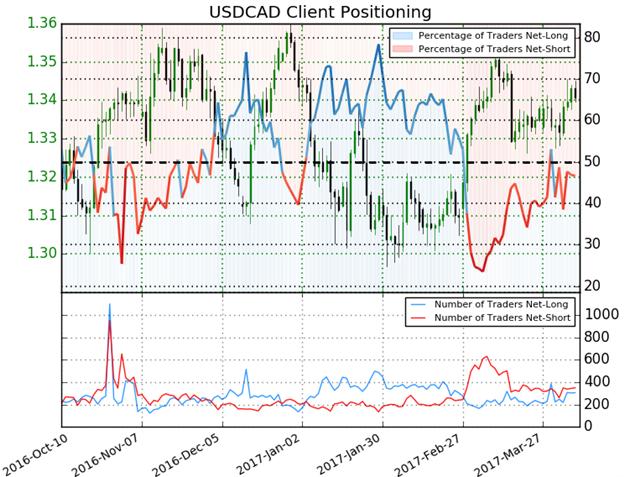

- A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are net-short USDCAD- the ratio stands at -1.14 (46.6% of traders are long)- weak bullish reading

- Long positions are 2.2% lower than yesterday but 12.5% higher from last week

- Short positions are 4.1% lower than yesterday and 6.2% lower from last week

- Despite the fact retail remains net-short, the recent decrease in short positioning continues to highlight the near-term risk for a move lower, especially as prices probe resistance.

---

Relevant Data Releases

Other Setups in Play:

- AUD/NZD Trapped- Rebound at Risk Below 1.09

- AUD/JPY: Sell-off Approaches Initial Support Hurdles

- GBP/USD: Fret Not, a Resolution is at Hand- Critical Support 1.23

- AUD/USD: RBA Game Plan & Levels to Know

- Webinar: Setups We’re Tracking into the Monthly / Quarterly Open

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.