Talking Points

- Review of current / active setups in focus into the start of the week

- Updated targets & invalidation levels

- Looking for more trade ideas? Review DailyFX’s 2017Trading Guides. Join Michael for Live Weekly Trading Webinars on Mondays at 13:30GMT (8:30ET)

The semi-annual Humphrey-Hawkins testimony with Chair Janet Yellen takes center stage this week and the broader technical focus for the DXY remains constructive. Updated technical setups discussed on DXY, USDCAD, NZDUSD, USDJPY, USDJPY, AUDJPY, AUDUSD, Crude Oil, Silver, Natural Gas, Gold, EURUSD, GBPUSD & GBPJPY.

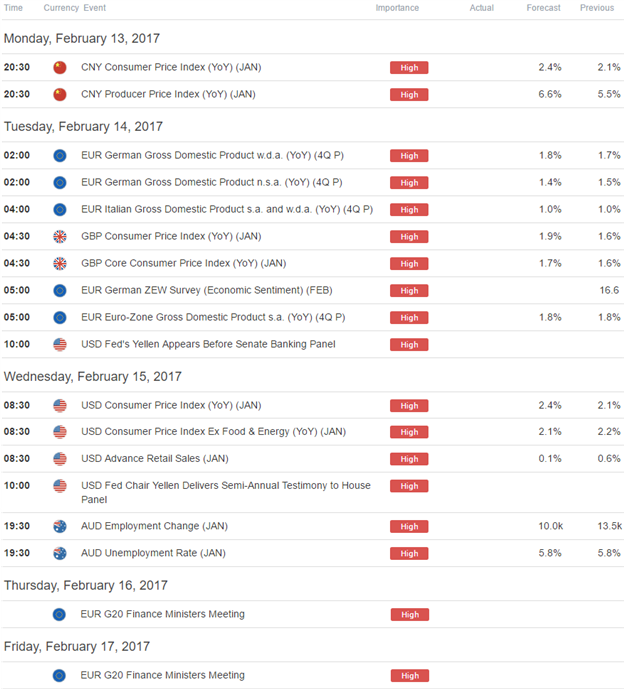

Key Data Releases

Other Setups in Play:

- Silver Eyes Key Resistance- Weakness to Be Viewed as Opportunity

- EUR/USD Eyes 1.0580 Support Ahead of 4Q GDP

- NZD/USD Rally Vulnerable Ahead of 7300- New Zealand CPI on Tap

- AUD/USD Risks Exhaustion on Record Low Core Inflation

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.