Talking Points

- GBP/USD pullback eyeing structural support into close of the week

- Updated targets & invalidation levels

- Click Here to be added to Michael’s email distribution list.

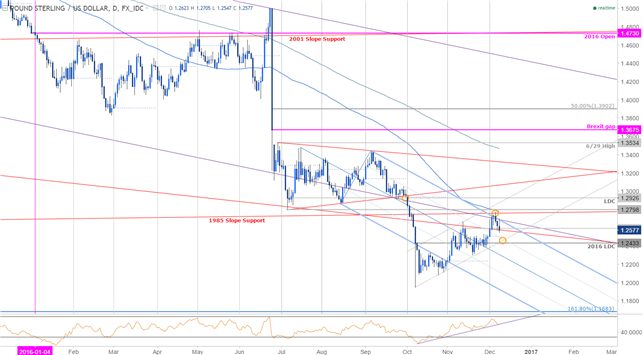

Technical Outlook: Sterling responded to a critical resistance barrier earlier this week at 1.2767/98- theregion is defined by the 50% retracement of the September decline, the 100-day moving average and numerous long-term median-line parallels. The near-term focus is on support targets at the monthly open at 1.2500/13 and the 2016 low-day close at 1.2433- both areas of interest for exhaustion / long-entries.

GBP/USD 120min

Notes: A basic trendline support extending off the 10/28 low converges the 100% extension of the decline and the 38.2% retracement of the advance at 1.2500/13 with our broader bullish invalidation level set at 1.2433. Interim resistance stands at 1.2624 & 1.2695 with a breach above 1.2767/98 needed to validate a breakout.

Keep in mind we have UK October trade balance figures on tap tomorrow ahead of U.S. consumer confidence. From a trading standpoint I’ll be looking to fade weakness into structural support with a breach of the weekly opening-range highs needed to suggest a more meaningful advance is underway in Cable. Such a scenario targets subsequent objectives at 1.2891 & the July low-day close at 1.2926.

- A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are long GBP/USD- the ratio stands at +1.53 (60% of traders are long)- bearish reading

- Long positions are 3.2% lower than yesterday and 2.4% below levels seen last week

- Short positions are 7.5% lower than yesterday and a 14.4% below levels seen last week

- Market participation has remained subdued with open interest 4.9% lower than yesterday and 9.0% below its monthly average.

- While the current SSI profile remains bearish, it’s important to note that retail has been net-long since September 13th. We’ll want to see an uptick in open interest alongside a build of long-positioning to reinforce a short-bias. That said, the immediate risk remains for a dip into key near-term structural support highlighted above.

Relevant Data Releases

Looking for trade ideas? Review DailyFX’s 2016 4Q Projections

Other Setups in Play:

- EUR/USD Volatility Ahead- Relief Rally Looks to ECB for Fuel

- EUR/AUD Approaching Decision Zone Ahead of Aussie GDP, ECB

- AUD/USD Recovery Hinges on RBA, 3Q GDP; Rally at Risk Sub-7600

- Webinar: USD Pullback Fueling Setups Across the Majors- Levels to Know

- USD/JPY Rally Eyeing Key Resistance Confluence Ahead of U.S. NFP

---Written by Michael Boutros, Currency Strategist with DailyFX

Join Michael for Live Weekly Trading Webinars on Mondays on DailyFX at 13:30 GMT (8:30ET)

FollowMichael on Twitter @MBForex or contact him at mboutros@dailyfx.com