Talking Points

- GBP/USD consolidation looks for resolution on BoE

- Updated targets & invalidation levels

GBPUSD 60min

Chart Created Using TradingView

Technical Outlook: Sterling is trading within the confines of a well-defined ascending median-line formation extending off the late-Julye lows with the advance reversing off the upper parallel in New York yesterday. Heading into the Bank of England (BoE) interest rate decision tomorrow morning, the immediate advance looks vulnerable while below basic trendline resistance extending off the 6/29 high.

Interim support rests with the 1.33-handle backed by the weekly / monthly open at 1.3235. Note that a sliding parallel extending off the 6/27 low also converges on this level heading into tomorrow. Broader bullish invalidation is set to the weekly opening-range low (1.3159/66).

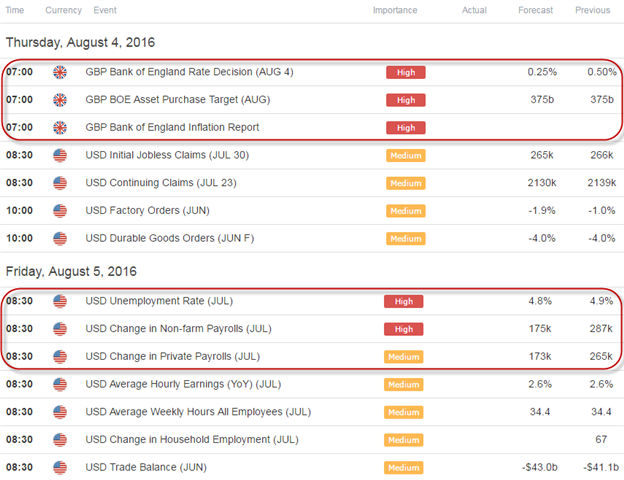

From a trading standpoint, I would be looking to fade sterling weakness into the rate decision while above 1.3159. Keep in mind markets are largely expecting a cut with 50 of 52 economists polled by Bloomberg calling for at least a 25bps cut (the most extreme bet calling for a 50bps cut). With that said, the risk for a rip higher in sterling if the central bank does not cut. A break lower targets 1.3055 & 1.2954. For the complete setup and to continue tracking this trade& more throughout the week- Subscribe to SB Trade Deskand take advantage of the DailyFX New Subscriber Discount.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

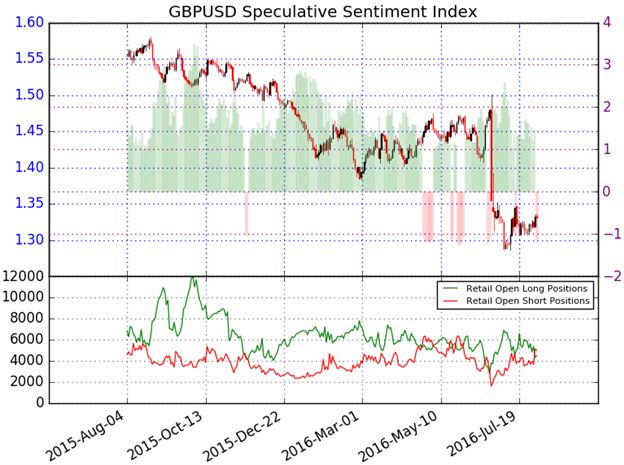

- A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are net short GBPUSD- the ratio stands at -1.12(47% of traders are long)-weakbullishreading

- Long positions are 3.3% higher than yesterday and 22.0% below levels seen last week. Short positions are 0.7% lower than yesterday and 38.3% above levels seen last week.

- Open interest is 1.1% higher than yesterday and 0.8% above its monthly average.

- SSI flipped to net short yesterday as the exchange rate rebounded off near-term structural support- constructive. An increase in short exposure on building open interest keeps the long-bias in play. That said, the pair is coming into key near-term resistance with the risk for a pullback before rallying to new highs. Keep in mind we also have the U.S. Non-Farm Payrolls report on tap for Friday.

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

Relevant Data Releases This Week

Other Setups in Play:

- GBP/JPY Bound to Support Before BoE

- EUR/USD: Looking for Opportunities to Buy Dips Heading Into U.S. ISM

- EUR/JPY Into the Gauntlet- Chasm of Support Awaits

- AUDUSD Vulnerable to RBA - Technicals Remains Constructive Above 7495

Looking for more trade ideas? Review DailyFX’s Top Trading Opportunity of 2016

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)