Talking Points

- USDCAD immediate short-bias at risk into BoC

- Updated targets & invalidation levels

USDCAD 30min

Chart Created Using TradingView

Technical Outlook: USDCAD failed to close above key resistance noted last week at the May high-day close at 1.3121 with the pullback breaking back below the weekly open, keeping the near-term focus lower in the pair heading into tomorrow’s Bank of Canada interest rate decision. Interim support rests at 1.2985 backed by 1.2949 & the monthly open at 1.2924 – both areas of interest for possible exhaustion / long-entries.

Resistance stands at 1.3015/22 backed by the weekly open at 1.3041- A breach above key resistance shifting the focus back towards key resistance at 1.3087-1.3104. Note that a close above 1.3121 is still needed to validate a breakout of the broader triangle consolidation pattern we’ve been tracking since the yearly low. Continue tracking this setup and more throughout the week- Subscribe to SB Trade Deskand take advantage of the DailyFX New Subscriber Discount.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

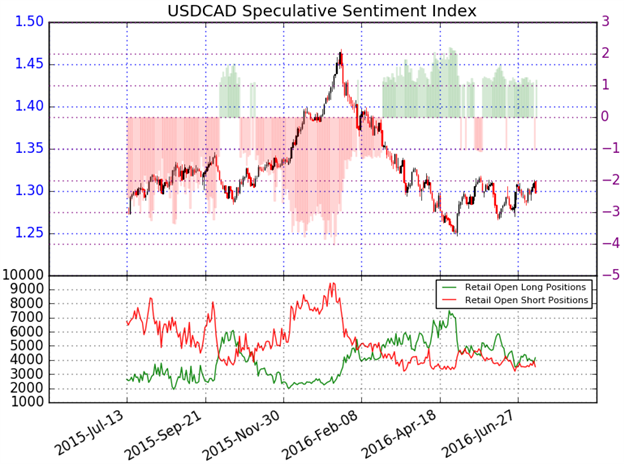

- A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are net long USDCAD- the ratio stands at +1.21(55% of traders are long)-weakbearishreading

- Yesterday the ratio was -1.09. Long positions are 15.3% higher than yesterday and 3.4% above levels seen last week.

- Open interest is 0.9% higher than yesterday and 3.1% below its monthly average.

- The recent flip from net-short suggests that the long-bias remains vulnerable- Immediate risk is for further declines near-term towards structural support

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

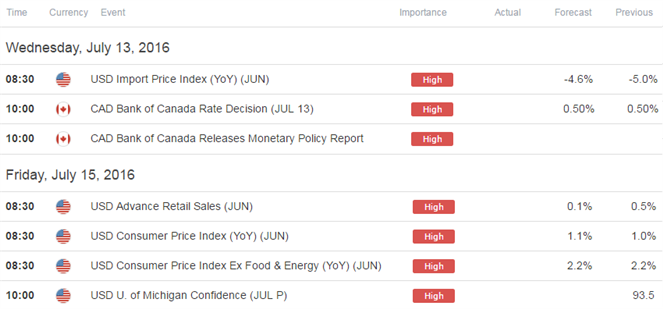

Relevant Data Releases This Week

Other Setups in Play:

- NZD/JPY Approaching Brexit High- Constructive Above 74.27

- Webinar: USD Crosses in Focus as Rally Eyes Key Resistance Targets

- USD/CAD Risks Near-term Breakout on NFPs / Canada Employment

- AUD/USD is Constructive - Threatens Resistance Break

Looking for more trade ideas? Review DailyFX’s Top Trading Opportunity of 2016

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)