- Key technical levels on the back of the historic Brexit vote

- Updated targets & invalidation levels

The implications of today’s Brexit vote will be far reaching and long-lasting as markets awaken to the dawn of a new day for Europe. From a trading standpoint, these unprecedented events make for difficult trading conditions as thin liquidity and vast daily trading ranges renders the near-term technicals of limited utility. Accordingly, it is prudent to use this time to reflect on the bigger picture to offer some clarity amid the chaos of these historic moves. With that said, here are some longer-term charts to consider and key levels we’ll be following on SB Trade Desk in the wake of the UK Referendum. Keep in mind more volatility is expected as US markets come online and we’ll want to see the dust settle before operating on these pairs- for now, we’ll be looking for reactions / inflections in price around these defined levels.

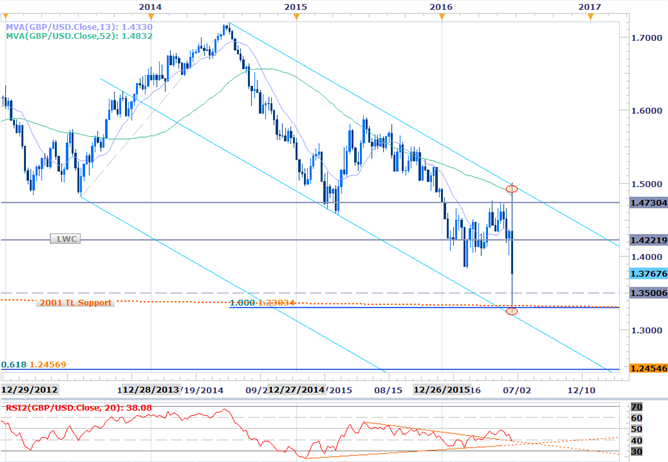

GBPUSD Weekly

Chart prepared by Michael Boutros

Notes:Sterling covered the entire 2016 range in one day with the pair rallying into channel resistance before reversing sharply to post its largest daily range in history. The low registered just below the 100% extension extending off the 2014 high at 1.3303- note that this level also converges on a trendline extending off the 2001 & 2009 lows as well as the median-line (blue). Interim resistance stands at 1.3834 (a weekly close below bodes well for continued weakness) with our broader outlook weighted to the downside while below 1.4222/25 where the February low-day close converges on the 2010 low. IF cable has bottomed, look for a breach of this level to clear the way for a rally back towards the upper parallel. A break below the 1.33 targets the 1.30-handle backed by the 1.618% extension at 1.2457.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

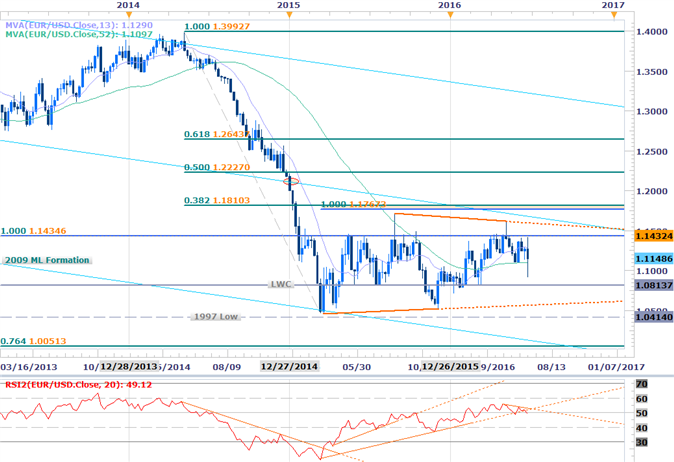

EURUSD Weekly

Notes:Euro has been trading within the confines of a well-defined descending median-line formation extending off the 2009 high and despite the Brexit volatility, the pair continues to hold within its yearly trading range. Support rests with the 2015 low-week close at 1.0814 with a break below trendline support targeting the 1997 low backed by the 76.4% retracement of the 2000 rally at 1.0051. Interim resistance is eyed at the 100% extension at 1.1435 with a breach of this consolidation formation targeting the median-line and a Fibonacci confluence at 1.1767-1.1810. From a trading standpoint, we’ll want to be mindful of the weekly close with the pair currently trading between the 52 & 13-week moving averages- again here a close below would keep the downside-bias in play.

Gold Weekly

Notes: Gold rallied into long-term structural resistance extending off the 2011 record high before reversing sharply amid ongoing divergence. The weekly close will be critical here and a close sub-1311 would leave the long-bias vulnerable heading into next week. Look for interim support at the 50-line (currently ~1255) backed by the ML extending off the July 2015 low. Subsequent support targets at 1202 & 1166 with key support at 1166/68. A breach / close of above channel resistance is needed to keep the long-bias in play targeting 1380, 1433 & the 50% retracement at 1483. Continue tracking this setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount.

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)