Talking Points

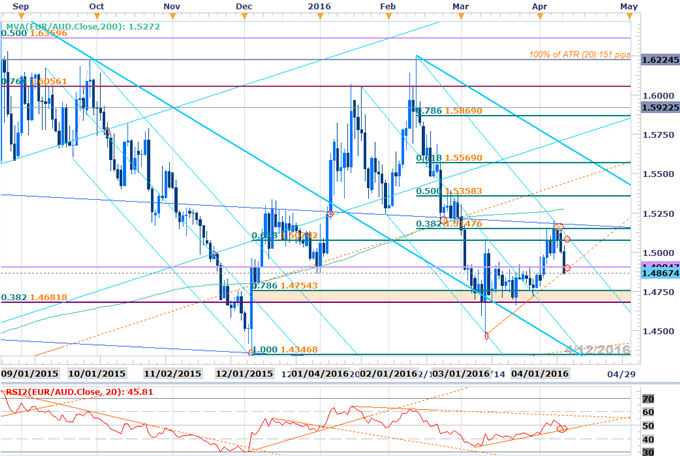

- EURAUD testing slope support- Immediate short-bias in play sub-1.4920

- Key support 1.4681-1.4708

- Updated targets & invalidation levels

EURAUD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook: EURAUD reversed off confluence resistance last week at the convergence of the upper median-line parallel and the 38.2% retracement of the decline off the yearly high, at 1.5148. The subsequent decline is now testing basic trendline support at the 2016 open – 1.4913 with our broader outlook weighted to the downside while bellow 1.5070/75. Note that daily momentum is also checking a basic support-trigger off the lows and a break here accompanying a move below trendline support would further reinforce the short-side bias.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

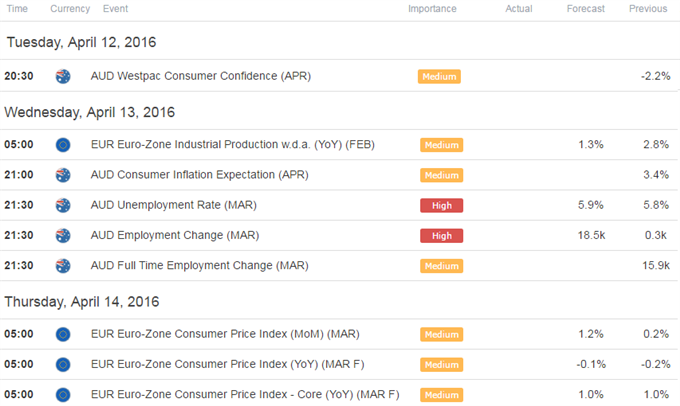

EURAUD 30min

Notes: The immeidate focus remains weitghed to the downside while below interim resistance at 1.4913/20 with a break lower tagreting 1.4833, the 61.8% retraceemnt at 1.4747 and key support into 1.4698-1.4703. A breach above near-term resistance opens up the possibility for a stretch back towards the upper median-line parallel before resuming lower. Such a scenario targets the 2016 low-day close at 1.4991 backed closely by 1.5028 & our bearish invalidation level at the upper median-line / 1.5070/75.

A quarter of the daily average true range (ATR) yeilds profit targets 37-40 pips per scalp. Added cuation is warranted heading into the Austalian employment report tomorrow night with the release likely to fuel volatility in the Aussie crosses. Continue tracking this setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount!

Check out SSI to see how retail crowds are positioned as well as open interest heading into the close of the week.

Looking for trade ideas? Review DailyFX’s 2016 2Q Projections !

Relevant Data Releases

Other Setups in Play:

- GBP/USD Scalp Targets Ahead of UK CPI- Bullish Invalidation 1.4175

- Webinar: USD in Free Fall- Key Crosses in Focus this Week

- USD/CAD Scalp Targets Ahead of Jobs- Key Support 1.2965

- GBP/USD 1.4175 is Near-Term Bull/Bear Dividing Line

- AUD/JPY Game Plan: Sell the Bounce- Bearish Invalidation 84.82

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)