Talking Points

- USDCAD at near-term resistance ahead of CAD employment data

- Near-term outlook constructive while above 1.2967/81

- Updated targets & invalidation levels

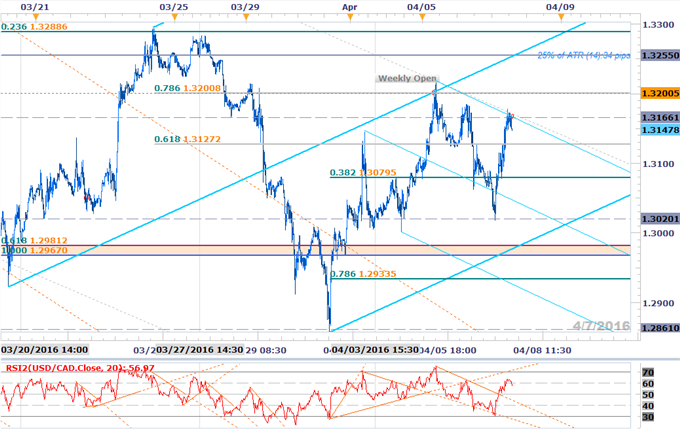

USDCAD 30min

Chart Created Using FXCM Marketscope 2.0

Technical Outlook: USDCAD made a strong defense of the weekly open last night at 1.3020, keeping our near-term focus higher in the exchange rate while above the lower median-line parallel extending off the 2016 low. The pair is testing near-term confluence resistance here and although we’re holding short scalps off this level, we’ll be on the lookout of resistance-triggers on a move lower to offer favorable long-entries.

A breach above slope resistance targets subsequent objectives at the 1.32-handle, last week’s open at 1.3255 & a basic 23.6% retracement of the yearly range at 1.3289. A break below the lower median-line (blue) invalidates our topside bias with a break sub-1.2967/82 needed to shift the focus back towards resumption of the broader decline off the January high. Such a scenario eyes support targets lower at 1.2933 & the October low-day close at 1.2861. Continue tracking this setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount!

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

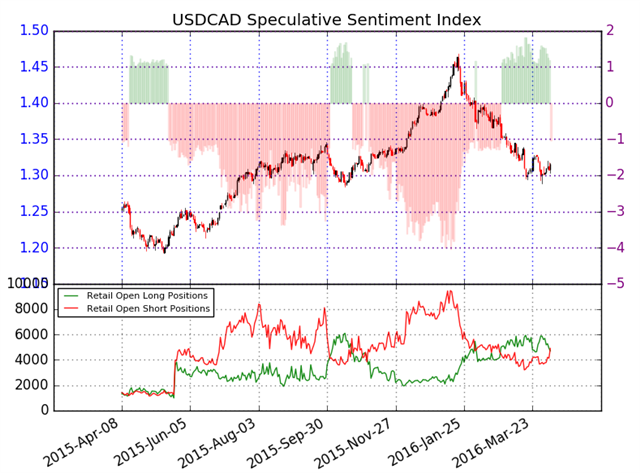

- The DailyFX Speculative Sentiment Index (SSI) flipped from net long to net short today with the ratio standing at -1.10 (49% of traders are long- down from 55% the previous day)

- Short positions are 15.5% higher than yesterday and 25.7% above levels seen last week

- Open interest is 1.2% higher than yesterday and 3.8% above its monthly average.

- The flip in the ratio on increasing open interest suggests that the retail short-bias may be waning (bullish near-term)

Why and how do we use the SSI in trading? View our video and download the free indicator here

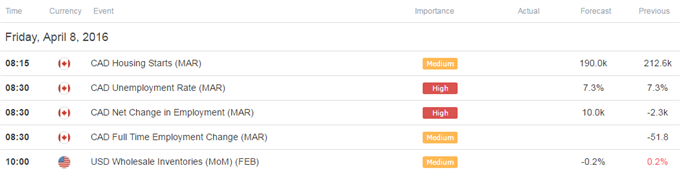

Relevant Data Releases This Week

Other Setups in Play:

- GBP/USD 1.4175 is Near-Term Bull/Bear Dividing Line

- AUD/JPY Game Plan: Sell the Bounce- Bearish Invalidation 84.82

- CAD/JPY Reversal Approaching Initial Support - Bearish Sub-86.53

- AUD/USD Into Support Ahead of RBA Interest Rate Decision

- Webinar: Start of Month, Quarter Yields Fresh Scalp Opportunities

Looking for more trade ideas? Review DailyFX’s Top Trading Opportunity of 2016

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)