Talking Points

- AUD/JPYReverses off confluence resistance

- Immediate focus lower- broader bullish invalidation 84.72

- Updated targets & invalidation levels

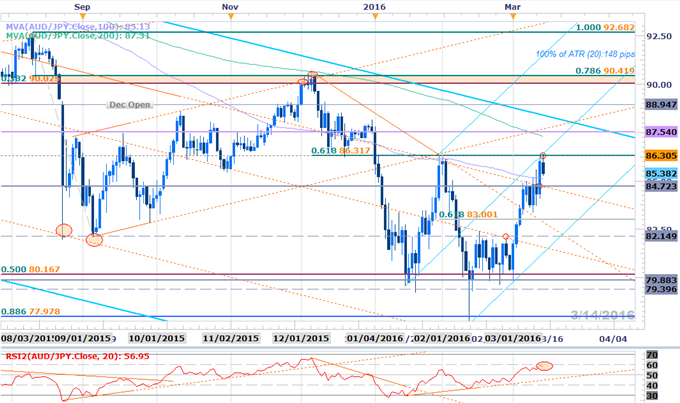

AUDJPY Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook: AUDJPY is responding to confluence resistance at 86.31- this level is defined by the 61.8% retracement of the December – January range, the late January/February high and the median-line extending off the January 15th outside reversal-day low. Note that the daily momentum signature is also testing resistance at 60 and could cap the advance near-term. Likely to get some more pullback here but the trade remains constructive near-term while above 84.72- a break below this level would suggest a larger correction may be underway targeting the lower median-line parallel, currently around ~82.15. This setup was highlighted in my Top Trading Opportunity of 2016.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

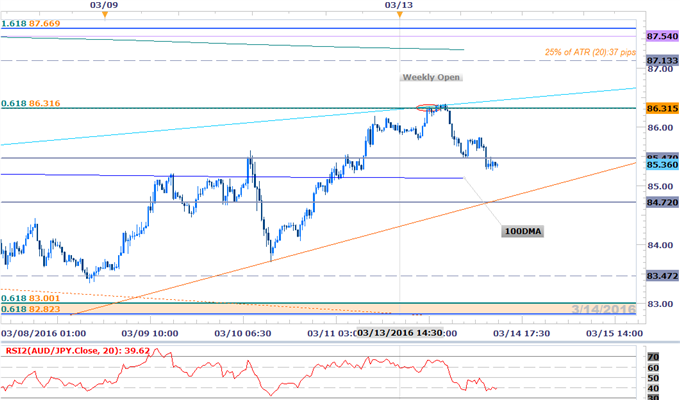

AUDJPY 30min

Notes: A basic trendline support extending off the late-February low converges on the 2015 low-day close at 84.72 and we will reserve this level as our near-term bullish invalidaiton level. Interim resistance stands at the 2015 low-week reversal close at 85.47 with a breach above 86.31 targeting subsequent topside objectives at the 200-day moving average at 87.31 backed by the 2016 open at 87.54.

A quarter of the daily average true range (ATR) yields profit targets of 35-39 pips per scalp. Added caution is warranted heading into the release of the RBA minutes tonight with the Australian employment report & the FOMC policy decision likely to fuel volatility in risk-sensitive pairs. Continue tracking this setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount!

Check out SSI to see how retail crowds are positioned as well as open interest heading into March trade.

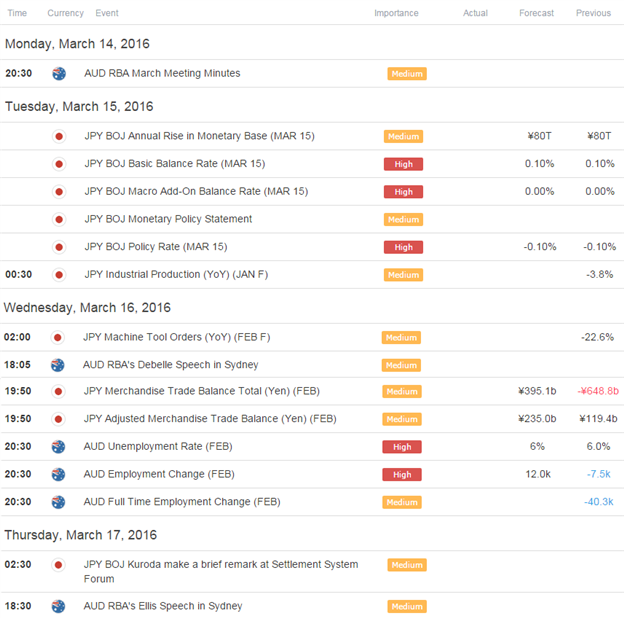

Relevant Data Releases

Other Setups in Play:

- Webinar: USDOLLAR FOMC Preview- Key Levels to Know

- AUD/CHF Deeper Sell-Off to Offer Favorable Entries

- GBP/USD Coils Below Key Resistance- Bullish Invalidation 1.3920

- USDOLLAR: Key Levels to Know Heading into NFPs, March Open

- USD/CHF Rebound Stalls at2016 Open- Bearish Invalidation 1.0072

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)