Talking Points

- EURUSD approaching apex of multi-month consolidation formation

- Updated targets & invalidation levels

- Event Risk on Tap This Week

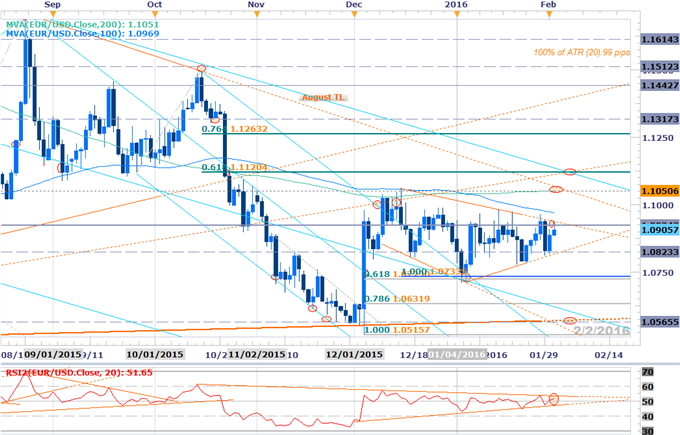

EURUSD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook: EURUSD has continued to consolidate into the apex of a formation darting back to the December high with the pair struggling to mount resistance at 1.0924. This level is defined by the December reversal high-day close and converges on basic trendline resistance over the next few days. A topside break of the formation is favored eyeing resistance objectives at 1.0970 (100DMA) & 1.1051 (200DMA). Note that this level coincides with basic TL resistance dating back to the August high. More significant resistance is eyed at 1.1120 where the 61.8% retracement of the October decline converges on the upper median-line parallel into the close of the week / open of next week.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders” series.

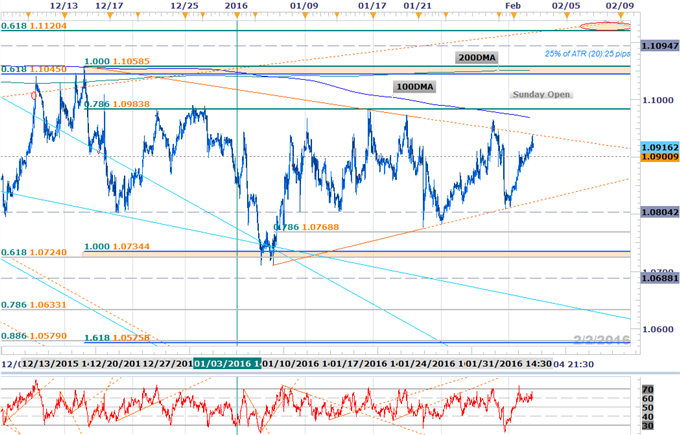

EURUSD 30min

Notes:The consolidation can be seen more clearly here on the 30min chart and we’ll be looking for a break of this range to offer guidance on the euro’s next leg. A topside breach is favored and so we’ll be looking to buy pullback’s / long-triggers while above the weekly opening range lows with a breach of the highs targeting the aforementioned resistance objectives.

A break below the figure invalidates our immediate long-approach with such a scenario eyeing support targets at 1.0769 & 1.0724/34. Note that the 2016 opening-range low comes in at 1.0709/10 and a break below this objective threshold would put the broader short bias back in play. A quarter of the daily average true range (ATR) yields profit targets of 23-26pips per scalp. Added caution is warranted heading into the close of the week with the U.S. Non-Farm Payrolls release likely to fuel volatility in the dollar crosses.

For updates on these setups and more trades throughout the week, subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount!

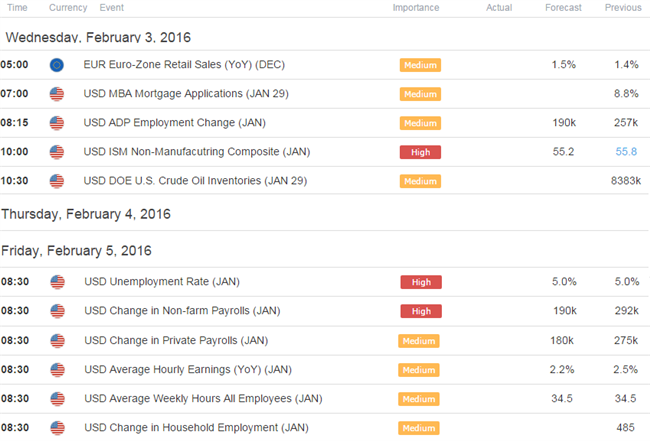

Relevant Data Releases

Other Setups in Play:

- Webinar: Aussie Crosses at Key Inflection Points Ahead of RBA

- EURAUD Approaches Critical Support- Longs Favored Above 1.5300

- AUDJPY Following 2016 Trade Plan- Time to Reload

- AUDUSD Rally Accelerates into Resistance- 7037 in Play

- GBPJPY Coiling For Next Big Move- Breach of 170.50 to Fuel Recovery

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or ClickHere to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)