Talking Points

- Weekly Scalp Webinar archive covering featured setups

- Updated targets & invalidation levels

- Event Risk on Tap This Week

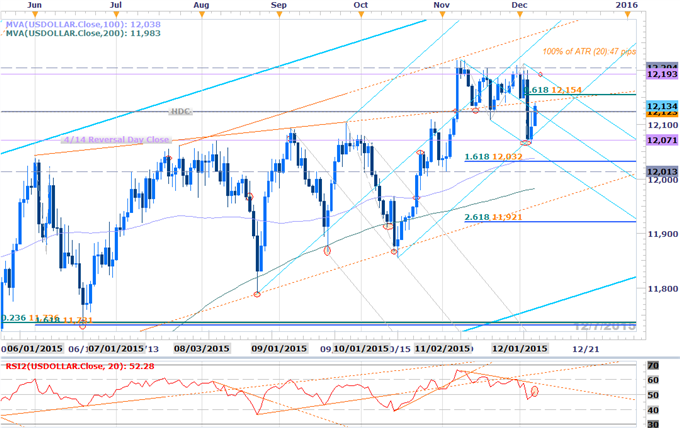

USDOLLAR Daily

Notes:The greenback is still on a stretch higher after Friday’s strong beat on Non-Farm Payrolls triggered a reversal off a support confluence at 12071. We’re on the lookout for short-triggers on this move with intereim resistance eyed at 12154 backed by the monthly open at 1293 (bearish invlaidation). A break of the lows targets 12032/38.

As we approach the holidays and thus illiquid markets, it’s worth reviewing principles that help protect your capital. We call these principles the "Traits of Successful Traders.”

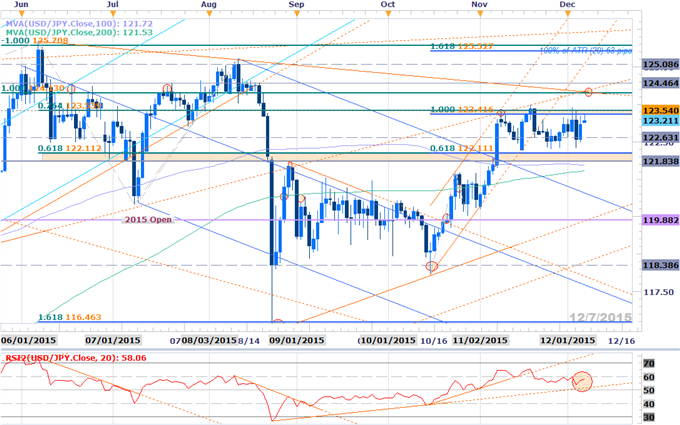

USDJPY Daily

Chart Created Using FXCM Marketscope 2.0

Notes: USDJPY continues to hold below resistance at 123.42/54 with the weekly & monthly opening ranges now taking shape just below. Note that momentum has continued to hold sub-60 with a pending support trigger in play. Bottom line- We’ll be looking for a break of this range with a breach higher targeting confluence support at 124.00/13 & the 6/8 reversal-day close at 124.46 (favorable shorts?).

Interim support rests at 121.83-122.11 with a break below this barrier needed to shift the medium-term focus back to the short-side of the pair targeting the 200DMA at 121.53 backed by former slope resistance near ~120.80.

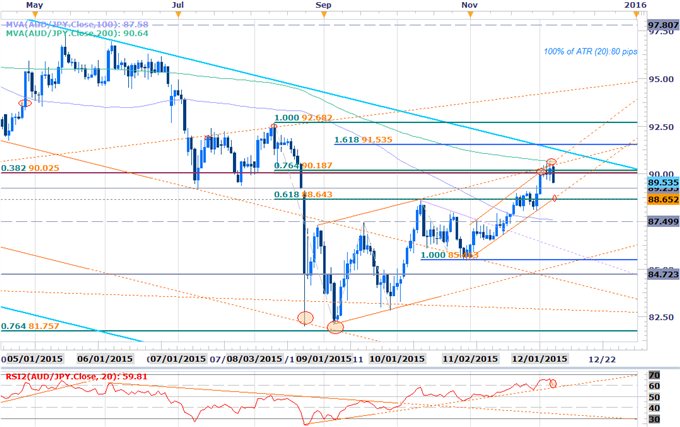

AUDJPYDaily

Notes: AUDJPY looks to be turning from a pivotal barrier after briefly testing above the 90.02/19 resistance confluence noted last week. The immediate focus is lower but we’ll be looking for this pullback to offer favorable long entries with interim support seen at 89.25 backed by our bullish invalidation level set at 88.65.

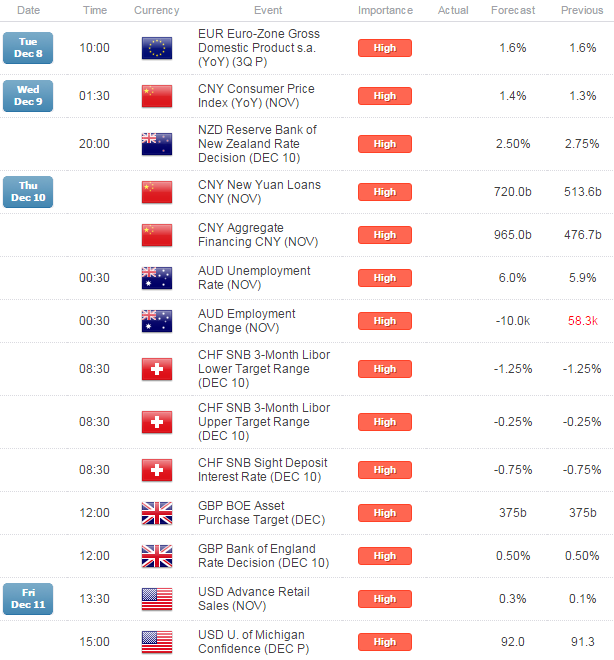

A breach of the highs targets resistance objectives at the upper median-line parallel / the 1.618% extension at 94.53. Keep an eye out for Australian employment data on Wednesday night in New York with consensus estimates calling for a loss of 10K in the month of November, fueling an uptick in the unemployment rate to 6%. Added caution is warranted heading into the print with the release likely to fuel volatility in the Aussie crosses.

For updates on these setups and more throughout the week subscribe to SB Trade Desk and take advantage of the DailyFX Subscriber Discount!

Relevant Data Releases Next Week

Other Setups in Play:

- Dual Jobs Report to Threaten USD/CAD Consolidation Range

- USDJPY Testing Uptrend Resistance- Key NFP Levels

- AUDJPY Rally Approaching Initial Resistance Hurdle

- AUD/NZD Pullback Testing Pivotal Support

- GBP/JPY Plummets Into Support- Sell Rips Sub 186

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or ClickHere to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)