Talking Points

- GBPJPY responds to near-term resistance- short scalps favored

- Updated targets & invalidation levels

- Event Risk on Tap This Week

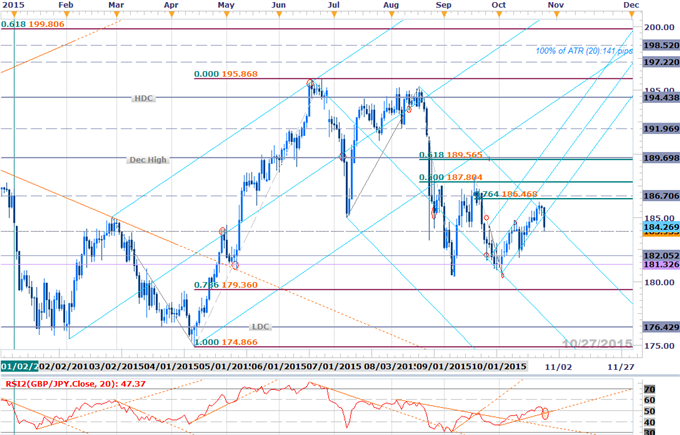

GBPJPY Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- GBPJPY reverses at resistance – breaks weekly opening-range low/channel support- bearish

- Interim support at 183.91 backed by 182.05 & the monthly open at 181.33

- Resistance & bearish invalidation at 186

- Breach targets subsequent resistance objectives at 186.47 & 2015 open at 186.70

- Daily RSI turn ahead of 60 – pending support-trigger break would be bearish

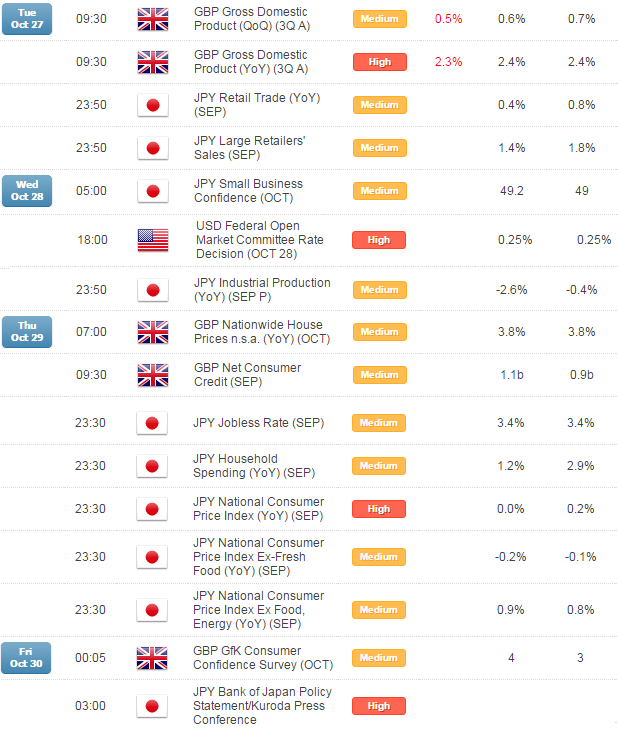

- Key Event Risk Ahead: Japan Retail Sales/Trade tonight, Industrial Production tomorrow and CPI & BoJ on Thursday night.

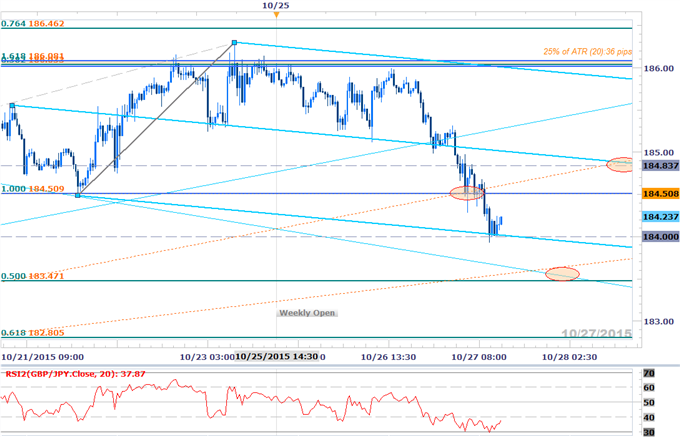

GBPJPY 30min

Notes: GBPJPY responded to a major Fibonacci confluence at 186.01/08 with a break below the weekly opening range shifting the focus to the short-side. Note that this region is defined by the 100% extension of the advance off the monthly low (two equal legs up) & the 38.2% retracement of the August decline and may have completed a more prominent correction.

That said, the immediate focus is lower (selling rallies) while below the median-line extending off the 10/21 high with a break below 184 targeting initial objectives at 183.47 & the 61.8% retracement at 182.80. A breach above the initial weekly opening range lows at 185.25 would be needed to shift the focus back to the long-side targeting the aforementioned key resistance zone at 186.

A quarter of the daily average true range (ATR) yields profit targets of 35-38pips per scalp. Caution is warranted heading into the end of the week / month with a long list of event risk still on tap. Of particular interest will be FOMC interest rate decision, Japanese Retail Sales / Trade, Industrial Production, Jobless rate, CPI and the BoJ. It’s going to be a big week for the yen crosses.

For updates on this scalp and more setups throughout the week subscribe to SB Trade Desk

Relevant Data Releases Next Week

Other Setups in Play:

- USDCAD Risks Reversal Below 1.3150 on Canadian CPI

- EURCAD Bulls Brace for ECB- Rally Vulnerable Sub 1.4955

- NZDCAD Posts Outside Day Reversal Pre-BoC; Shorts Face 8700 Hurdle

- Webinar: ECB/BoE Playbook- EUR/GBP Shorts Target Key Support Zone

- EURGBP Reverses Off Critical Resistance- Shorts Favored Sub 7386

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)

Struggling with your strategy? Here’s the number one mistake to avoid