Talking Points

- EURJPY at risk for pullback- Possible H&S setup

- Short-scalps favored against today’s high

- Event Risk on TapThisWeek

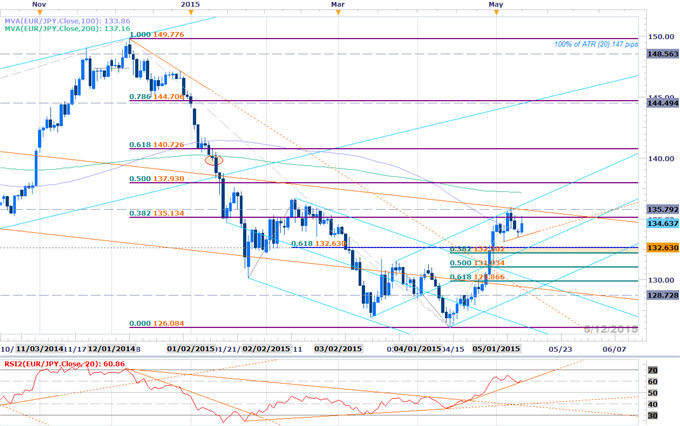

EUR/JPY Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- EURJPY setting monthly opening range below key resistance

- At risk for correction lower after tagging TL confluence last week

- Key support with the march median-line / 132.20/63 backed by 131& 129.87

- Breach above 135.79 needed to shift focus back to the long-side (bearish invalidation)

- Topside resistance objectives at the upper MLP, 137.16 & 137.93

- Daily RSI support trigger pending

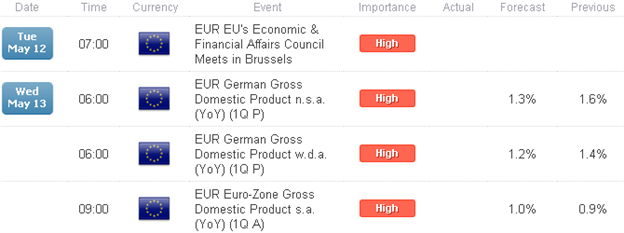

- Event Risk Ahead: Japan Trade Balance tonight & Eurozone GDP tomorrow

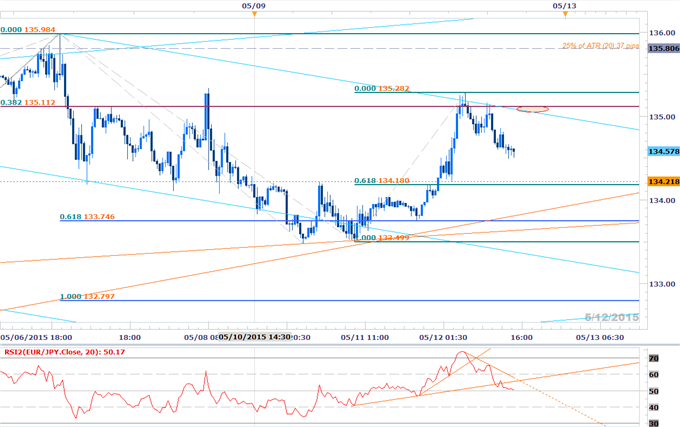

EUR/JPY 30min

Notes:EURJPY looks to be holding within the confines of a median-line formation off the initial May highs with last night’s rally reversing off the upper MLP / Fibonacci resistance into 135.12. Proximity to resistance & a subsequent turnaround in momentum has us holding shorts here with ¼ of the trade closed out at the initial 37pip ATR profit target. Interim support stands at 134.18/20 backed by the TL support / 133.74 & the weekly low.

Bottom line: looking lower against today’s high’s (near-term bearish invalidation) with a break below the weekly lows targeting the 132.80 region / the operative ML. Caution is warranted heading into event risk this week with Japanese Trade Balance Figures tonight and Eurozone GDP data tomorrow likely to fuel added volatility in EUR & JPY crosses. A breach above 135.28 invalidates our scalp bias with a push through 135.80 shifting the focus back to the long-side of the pair.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Relevant Data Releases

Other Setups in Play:

- Scalp Webinar: EURUSD Eyes Support- May Opening Range Setups in Focus

- Scalp Webinar: USD Rebound at Risk- AUD Bulls to Face RBA

- USDCAD Breakdown Stalls at Key Support- May Opening Range in Focus

- AUDJPY Breakout Scalps Target 200 DMA Ahead of BoJ, China PMI

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups visit SB Trade Desk

Follow Michaelon Twitter @MBForex,contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video