Talking Points

- USDJPY weekly opening range in focus

- Constructive bias at risk just below near-term resistance- 119.64

- Key Event Risk on Tap

USD/JPY Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- USDJPY holding within tight weekly range- 118.60- 119.64 in focus

- Breach targets 120.00/17, 121.44 & 121.84

- Support break targets 118.15 / pitchfork support (bullish invalidation)

- Momentum holding above 50- constructive

- Note pending RSI support trigger- Break would validate move sub-118

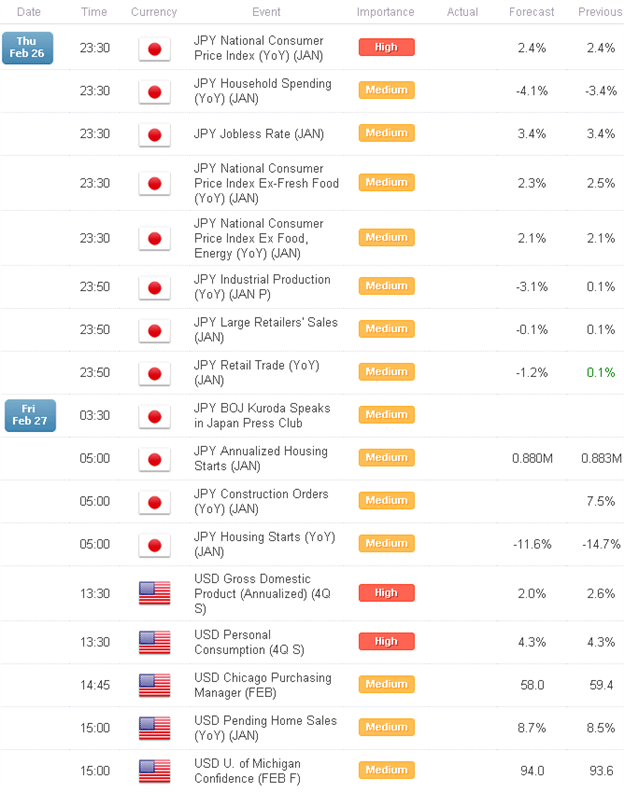

- Event Risk Ahead: Japan CPI, Industrial Production & Retail Trade tonight and US 4Q GDP & University of Michigan Confidence tomorrow

USD/JPY 30min

Notes: A proposed embedded formation may be in play here – further highlighting near-term resistance at 119.38/46. This level is defined by the 23.6% retracement of the late-January advance and the 100% extension of the advance off last week’s low. A breach higher eyes key resistance at 119.64 where a trendline off the monthly highs converges on a longer-dated 76.4% retracement of the late December decline. We are looking for a reaction off this level with a breach keeping the topside bias in play.

Bottom line: we’ll be focused on the 118.60- 119.64weekly range heading into tomorrow’s event risk with our bullish invalidation level pined to the lower median-line parallel of the embedded pitchfork. A quarter of the daily ATR yields profit targets of 22-25 pips per scalp. Caution is warranted heading into US 4Q GDP tomorrow with the print likely to fuel added volatility in USD based pairs.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Relevant Data Releases

Other Setups in Play:

- Scalping AUD/USD Opening Range Break- 7850 Support

- EURUSD Technicals Back in Focus- February Opening Range Setup

- Webinar: Scalp Setups Target Sterling Crosses

- GBPNZD Responds to Key Support- Scalps Target Resistance at 2.0550

- GBPJPY Scalps Target Key Resistance Range- Longs at Risk Sub 184

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX at 13:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video