Talking Points

- GBPNZD testing key support to open the month/year

- Shorts at risk above 1.9722- bullish invalidation

- Event risk on tap next week

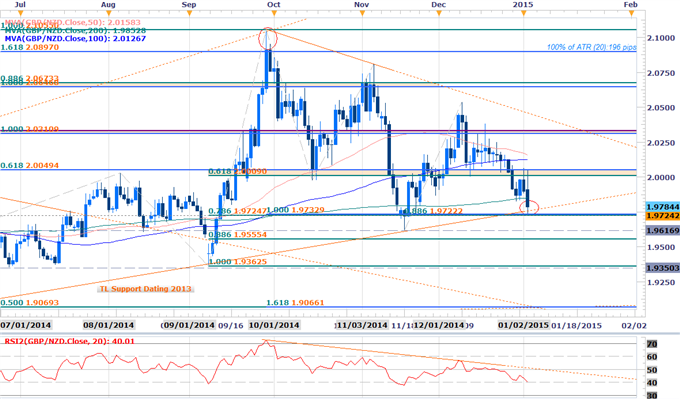

GBP/NZD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- GBPNZD testing key support region 1.9722/32- (bullish invalidation)

- Weekly / monthly opening ranges taking shape between 1.9722- 2.0060 – (bearish invalidation)

- Break to validate near-term scalp bias

- Daily RSI sitting at 40-support- break below would be bearish

- Event Risk Ahead: BoE Interest Rate Decision on Thursday & UK Industrial/ Manufacturing Production on Friday

GBP/NZD 30min

Notes:The range in focus here is 1.9722- 2.0060 as the weekly/monthly opening range takes shape just above key near-term support. The 1.9722/32 support range is defined by the 88.6% retracement of the late-November rally, the 100% extension off the 2014 high, the 78.6% retracement of the September rally and trendline support off the 2013 low.

The trade may not be quiet ready yet, but we’ll be tracking the pair for a break of this range with our base-case scenario favoring shorts while below TL resistance off the December high. Caution is warranted heading into the later part of the week with UK data likely to fuel added volatility in Sterling based crosses.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

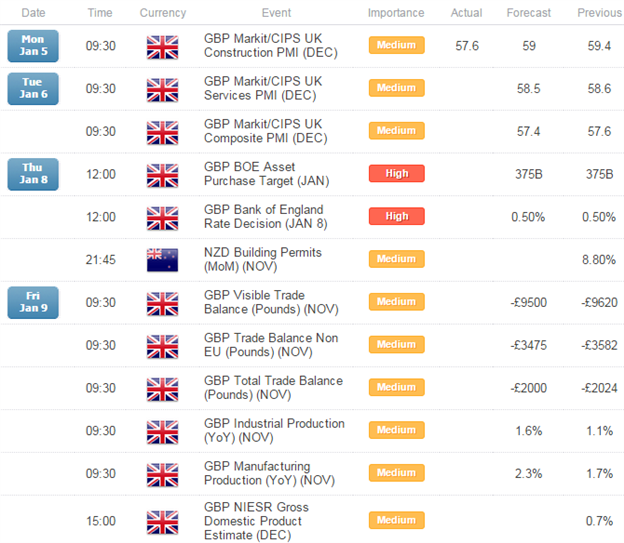

Relevant Data Releases

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX at 13:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video