Gold, XAU/USD, Non-Farm Payrolls (NFPs), Fed, Technical Analysis, IG Client Sentiment - Briefing:

- Gold prices soar in best single-day rally in almost 4 months

- Softer non-farm payrolls print may add to its push higher

- However, market divergence from Fed poses a risk to XAU

Gold prices gained 1.45% in the best single-day rally in about 4 months. A closer look at the price action revealed that XAU/USD rallied as the US Dollar and front-end Treasury yield weakened. This was an ideal scenario for the anti-fiat yellow metal.

The reaction in currency and bond markets might have been traders pre-positioning themselves for Friday’s non-farm payrolls report. A softer print could undermine the case for Federal Reserve tightening despite inflation still running at 40-year highs.

For July, the US is seen adding 250k jobs compared to 372k in June as the unemployment rate holds steady at 3.6%. Average hourly earnings are seen slightly dipping to 4.9% y/y from 5.1% prior. Much worse-than-expected figures would underscore rising concerns about a recession.

That might be ideal for gold if traders continue to focus on pricing in rate cuts for 2023. But, this is in stark contrast with what policymakers have been saying this week. Overall Fedspeak has been trying to quell expectations of a pivot.

This is setting up markets for a potential disappointment, placing gold at risk down the road. That said, this does not mean that traders will start to accept the reality that the Fed is trying to lay out. As famous Economist John Maynard Keynes said, “markets can stay irrational longer than you can stay solvent”.

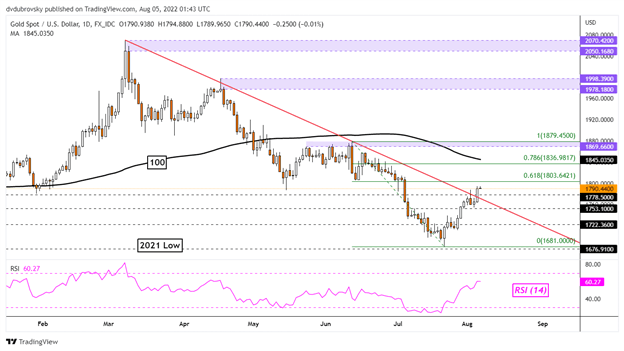

Gold Technical Analysis

Gold broke above a key falling trendline from March, opening the door to a broader reversal. That said, upside follow-through is lacking at the time of posting. Immediate resistance seems to be the 61.8% Fibonacci retracement level at 1803. Beyond that, the 100-day Simple Moving Average could kick in, holding as resistance. That may maintain the broader downside focus. Otherwise, a turn lower places the focus on 1753 before the July lows near.

XAU/USD Daily Chart

Chart Created Using TradingView

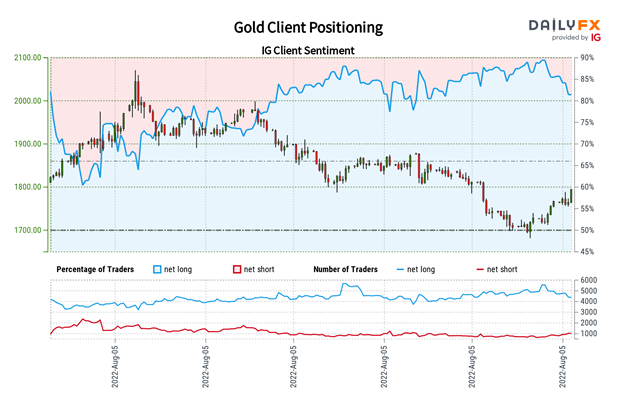

Gold Sentiment Outlook - Bullish

The IG Client Sentiment (IGCS) gauge shows that roughly 78% of retail traders are long gold. Since IGCS tends to function as a contrarian indicator, and the vast majority of investors are still long, this seems to hint that the price may continue falling. However, upside exposure has decreased by 6.41% and 15.90% compared to yesterday and last week respectively. With that in mind, recent shifts in positioning hint that the price trend may reverse higher.

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

*IG Client Sentiment Charts and Positioning Data Used from August 4th report