Gold, XAU/USD, FOMC, Treasury Yields, Breakevens, Technical Forecast - Talking Points

- Gold prices receive a boost from the Fed’s jumbo 75-basis-point rate hike

- The drop in Treasury yields helped boost XAU prices, but bond bears may return

- XAU/USD has potential to drop to the psychologically important 1,800 level

Gold prices are inching higher after an overnight bounce following the Federal Reserve’s 75-basis-point rate hike. A pullback in Treasury yields helped clear a path for bullion to rise as investors moved into bonds. The 5-year note’s yield fell 21 basis points, which took some wind out of the US Dollar’s sails. The DXY Index fell over half a percent. A weaker US Dollar and falling Treasury rates help to support gold’s investment appeal.

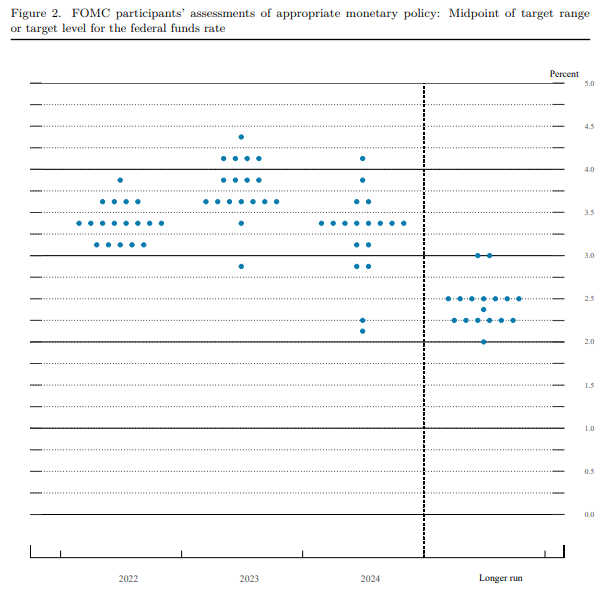

The pullback in yields following the FOMC decision hints that Mr. Powell gained some confidence back from the markets. While overnight index swaps and other market-based rate hike measures still see additional tightening ahead, the decision to go with a jumbo hike seems to have cooled inflationary fears in the Treasury and equity markets. The move is also likely to hit economic growth. But, it could also see Fed policy normalized sooner rather than later. The Fed’s dot-plot tool sees rate cuts potentially starting in 2024.

Despite the aggressive action, the Federal Reserve made an upward adjustment to its inflation outlook for this year, according to the FOMC’s summer of economic projections (SEP). The PCE inflation forecast for 2022 was raised to 5.2% from 4.3%. However, 2023 and 2024’s median projections fell to 2.6% from 2.7% and 2.2% from 2.3%, respectively. Breakeven rates—a market-based forward inflation gauge—remain higher than the Fed projections, however.

Those breakeven rates may drop in the coming days as markets price in the Fed’s latest action. If so, it would likely pressure gold prices. The fact that gold remains well off its recent highs, despite a red-hot CPI print last week, paints a bearish picture for the yellow metal’s prospects. Still, if nominal Treasury yields continue to ease in the coming days, it should allow XAU prices to rise, but a sustained rally doesn’t look tenable, given the fundamental backdrop. Bond bears are likely to return, given a still-aggressive rate-hiking path.

Source: federalreserve.gov

XAU/USD Technical Forecast

XAU/USD’s overnight gains are sputtering out through Asia-Pacific trading. The Relative Strength Index is moving lower after coming close to the oscillator’s midpoint. Moreover, MACD crossed back below its signal line. The psychologically important 1800 level remains a prominent target for bears. A break below 1800 could open the door for additional weakness. Alternatively, if strength resumes, the 61.8% Fibonacci retracement may offer a level of resistance.

XAU/USD Daily Chart

Chart created with TradingView

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter