Gold, XAU/USD, Fed, NFPs, Technical Analysis, IGCS - Talking Points:

- Gold prices reversed intra-day gains as US Dollar rallied post-Fed

- XAU/USD is eyeing non-farm payrolls report heading into weekend

- Death Cross in focus on the daily chart as retail traders bet bullish

Gold prices wiped out strong intra-day gains over the past 24 hours as risk appetite soured a day after the Federal Reserve raised benchmark lending rates by 50-basis points. On Wednesday, equity markets, and to a certain extent gold, rallied as Fed Chair Jerome Powell cooled future 75-basis point hike bets.

The swift reversal in the following 24 hours speaks to the reality that the yellow metal is facing. A hawkish central bank, with quantitative tightening just around the corner, tends to bode well for government bond yields and the US Dollar. The latter two are making things difficult for anti-fiat gold prices.

Heading into the weekend, XAU/USD is eyeing the highly anticipated US non-farm payrolls report. Traders may be paying particular attention to average hourly earnings to see how inflationary trends continue unfolding. Strong readings in the latter could bode ill for gold if the US Dollar and bond yields rally.

Gold Technical Analysis

Gold prices remain in a downtrend since topping in March. Broadly speaking, one could argue that an uptrend is in place since August. Prices are consolidating between falling resistance from March, and rising support from August. Until a breakout is achieved, the yellow metal may continue consolidating in-between these key trendlines. Recently, a bearish Death Cross emerged between the 20- and 50-day Simple Moving Averages. Further losses and clearing support exposes the 2022 low.

XAU/USD Daily Chart

Chart Created Using TradingView

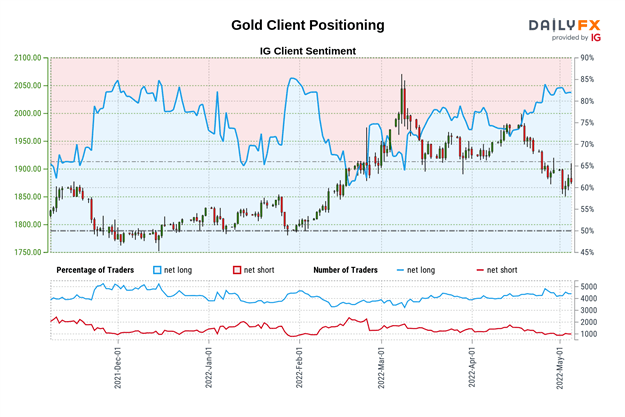

Gold IG Client Sentiment Analysis – Bearish

Looking at IG Client Sentiment (IGCS), about 83% of retail traders are net-long gold. IGCS can at times function as a contrarian indicator. Since most of them are biased to the upside, this suggests prices may keep falling. This is as downside exposure decreased by 17.99% and 13.87% compared to yesterday and last week respectively. With that in mind, the combination of current and recent changes in sentiment are offering a stronger bearish contrarian trading bias.

*IGCS data used from May 5th report

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter