Silver, XAG/USD, Fed, Yield Curve, Russia - Talking Points

- Silver is moving lower in Asia-Pacific trade despite risk-off news

- Yield curve steepens after FOMC minutes, hurting precious metals

- XAG/USD may swing if prices break nearby moving averages

Silver prices are lower through Thursday’s Asia-Pacific trading session, trimming gains made overnight. A pullback in risk aversion across Asian equity markets sapped the metal’s haven appeal, although reports of a possible skirmish in eastern Ukraine are seeing sentiment sour. South Korea’s KOSPI index remains up around 1% through mid-day trading although US equity futures are lower. This followed a mixed day on Wall Street when the Federal Reserve’s policy minutes signaled the possibility for faster rate hikes.

Prices may continue to fall this week if the current calculus holds and tensions in Ukraine don’t escalate further. The market has grown more confident in the Fed’s ability to orchestrate a soft landing, being a normalization of policy without causing a recession. The yield curve between the 2-Year and 10-Year Treasuries signaled just that, steepening overnight after dropping to its lowest spread since early 2020, coming within 38 basis points of inverting. An inversion is commonly seen as a recession predictor.

That said, the market is now more confident in the economic recovery continuing through rate hikes, sapping the metal of its inflation-hedging appeal. Higher rates alone also present an obstacle for the non-interest-bearing asset. The chance for a 50-basis point liftoff at the March FOMC meeting fell to 44.3% from 58.9% a day ago, according to the CME FedWatch Tool. For now, silver’s best hope for a move higher may be an escalation between Russia and Ukraine. Otherwise, prices may shift lower.

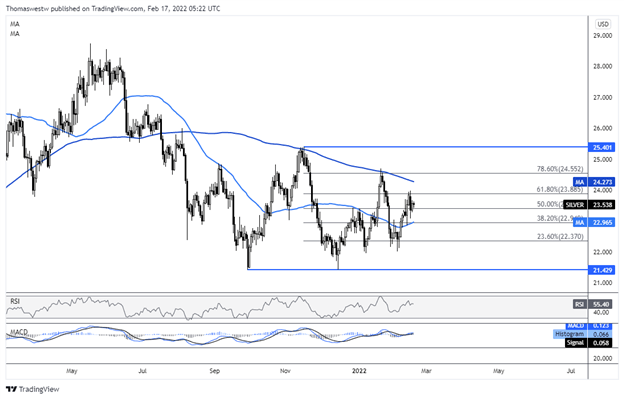

XAG/USD Technical Forecast

The technical outlook is fairly neutral for silver. Prices have been contained within the September to November range from 2021. The 50-day and 200-day Simple Moving Averages may offer more nearby support and resistance levels as prices trade just above the pseudo 50% Fibonacci level. A break above or below those SMAs may open the door for a directional move toward the September or November level.

XAG/USD Daily Chart

Chart created with TradingView

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter