CRUDE OIL OUTLOOK:

- Crude oil prices stall after surging to the highest in almost three months

- Fights over US debt ceiling, Biden-backed spending plans now in focus

- EIA production data eyed as output seems to rebound for Ida disruption

Crude oil prices are idling after spiking to the highest level in nearly three months amid supply shortage fears earlier in the week. EIA inventory data showing unexpectedly large 4.6-million-barrel build last week – the largest increase in almost seven months – did not appear to have much lasting influence.

That may be because the outsized rise was telegraphed in the private-sector inventory flow estimate from the American Petroleum Institute (API) on the prior day. It flagged a slightly more modest 4.1-million-barrel stockpiles rise, which visibly compounded Tuesday’s pullback.

US fiscal policy may capture the spotlight from here as Congressional lawmakers scramble to avert hitting the self-imposed “debt ceiling” at the week-end, all while trying to pass a bipartisan US$1 billion infrastructure spending plan. Success on these fronts may lift sentiment, offering a boost to cycle-sensitive oil prices.

On the data front, the EIA will release monthly petroleum supply statistics. Weekly data shows output has recovered to the 3- and 6-month trend averages after disruption by Hurricane Ida triggered a sharp drop-off in late August. Confirming as much may relieve some upward pressure, allowing WTI to deflate a bit.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

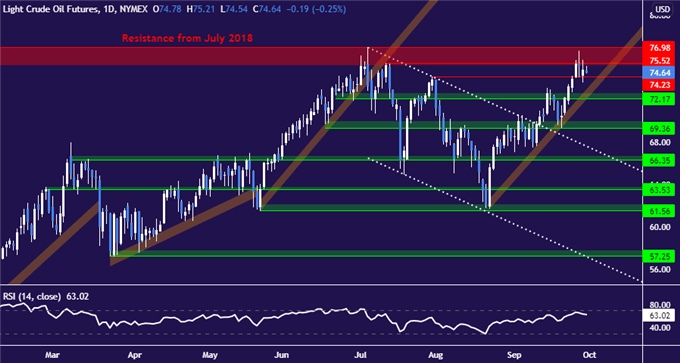

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are testing three-year resistance just below $77/bbl. A break above this barrier may open the door for a test above the closely-watched $80/bbl figure. Neutralizing the near-term upside bias seems to demand a daily close below 72.17. That would violate the series of higher highs and lows from August’s lows. Subsequent downside barriers line up at 69.36 and 66.35.

Crude oil price chart created using TradingView

CRUDE OIL TRADING RESOURCES

- What is your trading personality? Take our quiz to find out

- See our guide to build confidence in your trading strategy

- Join a free live webinar and have your questions answered

--- Written by Ilya Spivak, Head Strategist, APAC for DailyFX

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter