Crude Oil, Gold, XAU/USD, Suez Canal Blockage, US PCE Data, Commodities Briefing - Talking Points:

- Crude oil prices weakened despite blockage at Suez Canal

- Gold prices consolidating as USD gains, bond yields drop

- All eyes on US PCE data, soft figures may weaken the USD

Crude oil prices fell on Thursday, giving up a decent chunk of gains from Wednesday as a blockage at Suez Canal increased concerns about global supply distribution. It is estimated that about 2 million barrels of crude oil are being withheld each day the container ship remains stuck on the sandbank. The decline in WTI over the past 24 hours thus likely reflected more prominent, broader fundamental themes.

Parts of Europe, such as France and Italy, have reintroduced lockdowns to tackle rising Covid cases. This has increased concerns about the demand for energy prices. Meanwhile, the haven-linked US Dollar has been on the rise amid some stock market volatility. Given that crude oil is largely priced in the Greenback, it makes sense that strength in the USD can bode ill for the commodity. The same can also be true for gold.

Weakening longer-term Treasury rates are acting as a cushion for XAU/USD, given that the yellow metal is a non-yielding asset. This likely explains why the precious metal has seen fairly quiet trading conditions as Treasury rates fell and the US Dollar strengthened. With that in mind, what are some risks that crude oil and gold prices face heading into the weekend?

All eyes turn to US personal income data, where spending is anticipated to shrink 0.8% in February amid severe cold weather that knocked out power across parts of Texas. A soft core PCE reading, the Fed’s preferred gauge of inflation, may also cool the bond market further. That may offer breathing space for gold and crude oil if the US Dollar losses some ground over the next 24 hours.

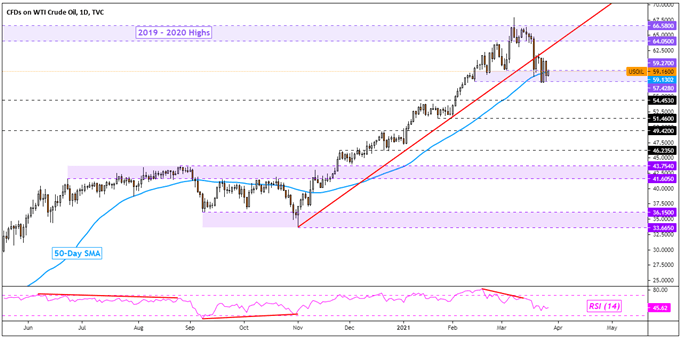

Crude Oil Technical Analysis

Crude oil prices remain at risk in the near-term given that WTI has managed to confirm a break under rising support from November. However, the commodity hasn’t been able to breach the critical 57.42 – 59.07 support zone I highlighted last week. Prices are also consolidating around the 50-day Simple Moving Average

WTI Crude Oil Daily Chart

Chart Created Using TradingView

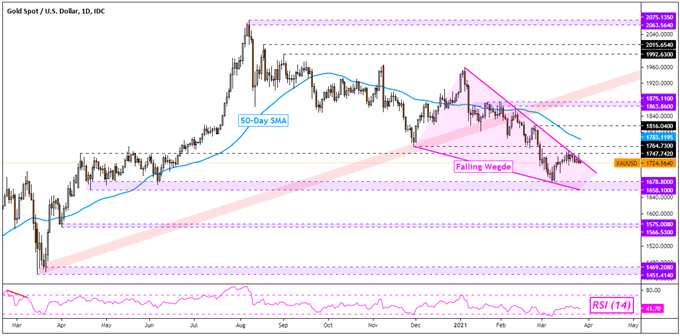

Gold Technical Analysis

Gold prices continue to trade within a bullish Falling Wedge chart pattern. The ceiling of the wedge seems to be guiding XAU/USD cautiously lower. This could precede a retest of the key 1678 – 1658 support zone. Otherwise, a push above the wedge exposes the 50-day SMA as well as the 1747 – 1764 inflection range.

Gold Daily Chart

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter