CRUDE OIL & GOLD TALKING POINTS:

- Crude oil prices struggle to hold gains, pinned to chart resistance

- Gold prices perched at trend-defining support above the $1900/oz

- All eyes on Fed Chair Powell speech at Jackson Hole symposium

Crude oil prices got a lift as the US Dollar weakened yesterday, offering de-facto support. The rise proved fleeting however, with the WTI benchmark shrugging off EIA data showing inventories fell more than expected last week to finish the session little-changed.

Traders may have been unwilling to commit to lasting gains as they weigh a range of uncertainties, from the near-term impact of Hurricane Laura on refining capacity in the Gulf Coast region to the broader outlook for demand as the Covid-19 outbreak continues to cause disruption.

Gold prices managed a more spirited advance at the Greenback’s expense, reveling in the appeal of anti-fiat alternatives as the benchmark currency declined. That probably reflects pre-positioning ahead of a much-anticipated speech from Fed Chair Powell at the virtual Jackson Hole symposium today.

CRUDE OIL, GOLD MAY FALL AS POWELL SPEAKS AT FED SYMPOSIUM

Mr Powell is widely expected to offer guidance establishing the outlines of an updated Fed policy framework for the near to medium term. Broadly speaking, a change in the way the central bank targets inflation is expected as a way to signal that faster price growth will be tolerated before tightening ensues.

This is essentially in line with the thrust of recent commentary from Fed officials, where they appear to acknowledge the limitation so of monetary policy to create demand. Put simply, they argue that easing is meant to encourage recovery once it is underway, not jump-start growth.

That logical framework appears to have guided the Fed away from expanding its stimulus toolkit to include ever-more experimental efforts like ‘yield curve control’ or negative target interest rates. Mr Powell will likely assert as much again. This has disappointed markets previously, and may do so again.

Crude oil prices may fall alongside stocks in this scenario as market-wide risk appetite sours. Gold prices look likewise vulnerable as risk aversion couples with the pricing in of a more limited scope for additional accommodation. That is likely to boost USD and trim the appeal of anti-fiat alternatives.

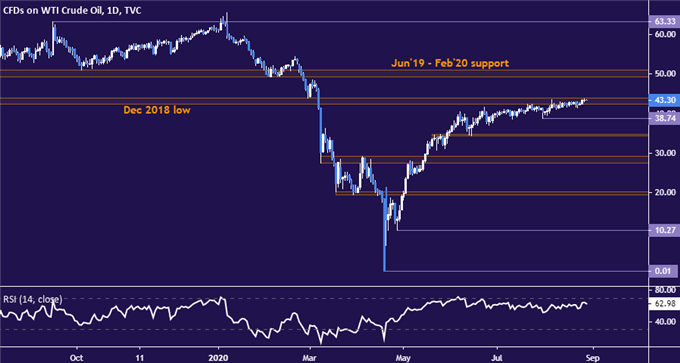

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are pushing up against the upper bound of long-standing resistance in the 42.40-43.88 area. Breaking above that on a daily closing basis may expose the $50/bbl figure. Alternatively, a fall below swing-low support at 38.74 likely aims for the 34.38-78 inflection zone next.

Crude oil price chart created using TradingView

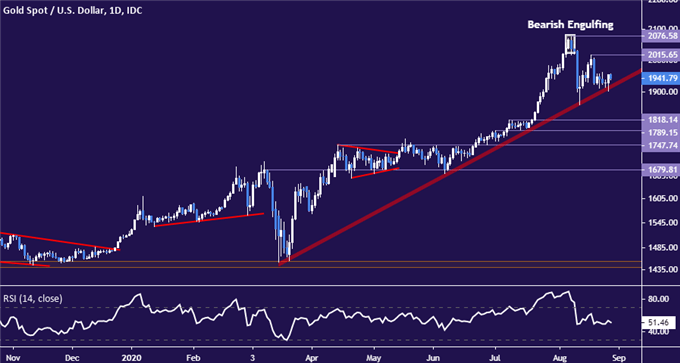

GOLD TECHNICAL ANALYSIS

Gold prices are perched atop rising support guiding the uptrend from March lows. A daily close below that may mark a lasting bearish reversal, initially targeting support near $1800/oz. Alternatively, a break above the swing top at 2015.65 opens the door for a test of the record high at 2076.58.

Gold price chart created using TradingView

COMMODITY TRADING RESOURCES

- See our free guide on the drivers of crude oil price trends

- What is your trading personality? Take our quiz to find out

- Join a free live webinar and have your questions answered

--- Written by Ilya Spivak, Head APAC Strategist for DailyFX

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter