Crude Oil and Gold Talking Points:

- Crude oil prices were steadier after steep falls in the previous session

- There’s till very little reason for bullishness however

- Gold prices slid further despite the metal’s haven attractions

Crude oil prices steadied in Asia Pacific trade on Wednesday having fallen to four-year lows in the previous session as investors continued to fret the effects of coronavirus on economic performance and, therefore, demand for energy.

A fall in US stockpiles reported by the American Petroleum Institute on Tuesday may have provided some support to the market but between coronavirus and the price war between major producers Russia and Saudi Arabia, traders were otherwise preoccupied. Official inventory levels from the Department of Energy are due later.

Overall risk appetite remains extremely weak, with local stock market fortunes mixed despite the boost given to Wall Street by proposed massive fiscal support for the US economy which could include simply handing over cash to millions of Americans. This proposed experiment in so called ‘helicopter money’ would be the largest example of the practise yet seen.

| Change in | Longs | Shorts | OI |

| Daily | -2% | -7% | -3% |

| Weekly | 20% | -25% | 3% |

Gold prices made some gains as news of the administration’s proposals made its way around the world but they slipped back as the session went on.

Despite clearly elevated economic uncertainty which might be expected to support all haven assets, gold has fallen sharply this month, reportedly as investors liquidate their holdings to cover losses elsewhere.

| Change in | Longs | Shorts | OI |

| Daily | -2% | -2% | -2% |

| Weekly | 3% | 16% | 10% |

Crude Oil Technical Analysis

This month’s effective freefall has seen crude prices return to lows not previously seen since late 2003. They’re now in some danger of erasing the entire rise from the lows of December 2002 when prices were just a little below $18/barrel. It seems unlikely that any modern-day producer could long tolerate those levels, but they’ll remain in play unless we see some broad near-term recovery in risk appetite.

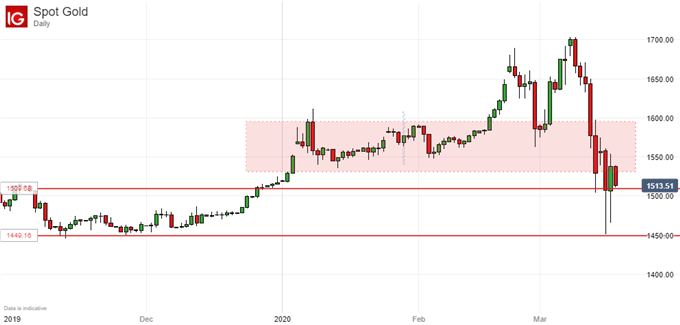

Gold Technical Analysis

Gold prices remain effectively trapped between their former trading range and support which now comes in at $1509.78, or 78.65 Fibonacci retracement of the rise from last November’s lows to this year’s peaks. While complete retracement is now a clear threat, the market is likely to retain its fundamental underpinnings for as long as the coronavirus continues to rage. Watch for a daily or weekly close below that level, however.

Commodity Trading Resources

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your commodity market questions answered

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!