Gold and Crude Oil Talking Points:

- Crude oil prices were lower on news of a big spike in US supplies

- Beijing responded angrily to the signing by Donald Trump of legislation supporting democracy and human rights in Hong Kong

- The extent to which this might derail trade talks is now on top of market worry lists

Join our analysts for live, interactive coverage of all major economic data at the DailyFX Webinars. We’d love to have you along.

Crude oil prices slipped in Asia Thursday following news of another strong US inventory build and record weekly production.

Stockpiles rose well ahead of expectations to 1.6 million barrels last week, with 12.9 million barrels per day produced.

Risk appetite was also blunted by China’s angry response to President Donald Trump signing legislation in support of democracy and human rights in Hong Kong, putting the Administration firmly on the side of anti-Beijing protesters.

China accused the US of meddling and ‘sinister’ purpose. Of more immediate concern to markets will be the effect if any on the interim trade accord whose supposed proximity has bolstered risk appetite this week.

The US Thanksgiving break will probably see markets calmer, if more thinly traded and perhaps volatile. However, all energy markets are now looking towards December’s meeting of the Organization of Petroleum Exporting Countries at which production cuts which also include Russia are likely to be extended.

Gold Gets Haven Support, Looks To European Data

Gold prices were supported as risk appetite dried up, with anti-cyclical, haven currencies like the Japanese Yen and Swiss Franc also gaining. Palladium made a record high before paring gains. The precious metal is a key ingredient in catalytic converters and its price has risen more than 40% this year thanks to scarce supply.

This market faces one or two major European risk events Thursday. Swiss growth data are expected to show continuing weakness and may support the bid into gold if so. Germany’s consumer price inflation however is expected to weaken on the month in November. Weaker pricing power tends to hit gold which often features in portfolios as an inflation hedge.

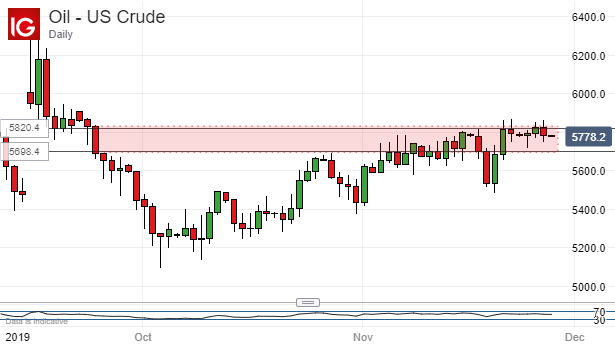

Crude Oil Technical Analysis

US crude prices remain rather fascinatingly trapped within a range which corresponds closely to the trading action seen on September 24 when the market fell sharply.

While still in an obvious strong uptrend from October’s lows, the market has failed to make a convincing daily close above the top of that range. Unless risk appetite decreases sharply it will probably manage this feat in the coming days, but the uncommitted may be wise to treat the next few days’ holiday affected moves with suspicion.

Gold Technical Analysis

Prices continue to creep lower within a broad daily chart range defined by the first and second Fibonacci retracements of the rise up from the lows of May to the peaks of September.

Prices have found support above the lower band around the lows of November 10 in the $1455 region. While the market is unsure as to what degree US political action will stymie a trade accord it seems unlikely that gold’s haven bid will abandon it so far as to admit a challenge to the range base. That said the bulls will probably need to regain the previous significant peak if they’re to mount a serious response to recent weakness.

That’s at $1478 and looks like quite a big near-term ask.

Commodity Trading Resources

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your commodity market questions answered

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!