Gold and Crude Oil Talking Points:

- Crude oil prices weakened once again as some trade doubts crept back in

- Wire reports suggest White House resistance to some proposed aspects of an interim deal

- Gold prices looks set for a notably feeble week even so

Join our analysts for live, interactive coverage of all major economic data at the DailyFX Webinars. We’d love to have you along.

Crude oil prices slipped back a little Friday as investors fretted the details of the latest twist in the US-China trade tale. Headlines on this subject will remain crucial as the week bows out, especially as scheduled economic data are limited.

Global market sentiment had been lifted in the previous session by a China’s Commerce Ministry. Its spokesman Gao Feng said that both Beijing and Washington had agreed to simultaneously remove some trade tariffs as steps toward a ‘phase one’ trade agreement. However, while Reuters confirmed this from the US side quoting an unnamed official, the agency went on to report that the current accord faces ‘fierce internal opposition’ in the White House.

Oil prices were already weighed down by news of another huge US inventory build, news of which hit in the previous session. This market looks extremely well supplied by any measure and it may take extended or deeper production cuts from traditional producers to seriously challenge this view.

The gold market still seems more sanguine about the chances of a trade deal. Hopes for one have played a major role in what looks as though it will be the worst week for spot gold prices since May 2017. The current level represents about a 3$ slide on the week, with the market back down to levels not seen since early August.

The coming week is short of major global economic news by Wednesday’s interest rate decision from the Reserve Bank of New Zealand may remind markets that even their optimism is grounded in ultra low interest rates. The RBNZ is not thought likely to reduce the record-low Official Cash Rate next week, but has been known to spring surprises in the recent past.

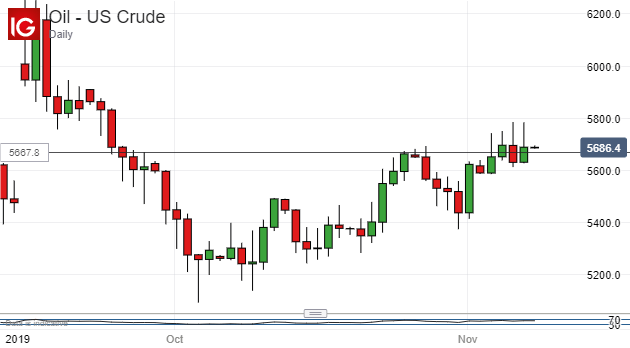

Crude Oil Technical Analysis

Spot prices remain within their dominant uptrend but have yet to convincingly top their previous significant daily chart high.

If they can’t there is some danger that prices will top out and begin to retrace their climb up from October’s lows. However, bulls have doggedly retaken much of the sharp falls seen in late September which took the price down to those lows in the first place, and there’s no evidence that they are ready to give up that fight quite yet.

Gold Technical Analysis

Prices have slid below the base of a trading band which held through much of October, putting focus back on the long downtrend in place since early September.

The most obvious likely near-term support comes in at 1449.22. That’s the second, 38.2% Fibonacci retracement of the rise up to September’s highs from the lows of late May. A test of that will mark a conclusive break below October’s lows.

Commodity Trading Resources

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your commodity market questions answered

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!