CRUDE OIL & GOLD TALKING POINTS:

- Crude oil prices fall on demand fears as IMF cuts global growth bets

- Gold prices decline as stocks, bond yields amid risk appetite recovery

- Fading Brexit breakthrough hopes might sour market-wide sentiment

Crude oil prices were unable to capitalize on another burst of Brexit deal optimism lifted market-wide risk appetite. The WTI contract attempted to push higher alongside share prices but a downbeat global growth outlook from the IMF soured expectations for demand and push it back downward into the daily close.

Gold prices remained tied to overall sentiment trends however, succumbing to selling pressure as hopes for a UK/EU breakthrough drove bond yields higher. That undermined the appeal of non-interest-bearing assets epitomized by the yellow metal.

CRUDE OIL PRICES MAY FALL ON COOLING BREXIT DEAL HOPES

Looking ahead, Brexit-related headline flow may continue driving seesaw volatility as negotiators scramble to get the outlines of an accord in place before Thursday’s EU leaders’ summit. Markets have been willing to give officials the benefit of the doubt so far, but time is running out and confidence may ebb.

Most worryingly, whatever pact is ironed out between the government of UK Prime Minister Boris Johnson and EU officials seems likely to face an uphill battle in the UK Parliament. Reports suggesting failure is most likely are already cooling risk appetite. Bellwether S&P 500 futures are pointing tellingly lower.

This might keep oil prices pressured for a third day straight. API inventory flow data might compound weakness if the print endorses forecasts suggesting stockpiles rose for a fifth consecutive week. Gold might find a lifeline if the downbeat mood sends yields lower.

The US retail sales report headlines the economic data docket. Receipts growth is expected to have slowed in September but a recent run of outperformance relative to baseline forecasts hints that an upside surprise might be in the cards. That might offset the downbeat mood a bit, if only nominally.

Get our free guide to help build confidence in your gold and crude oil trading strategy !

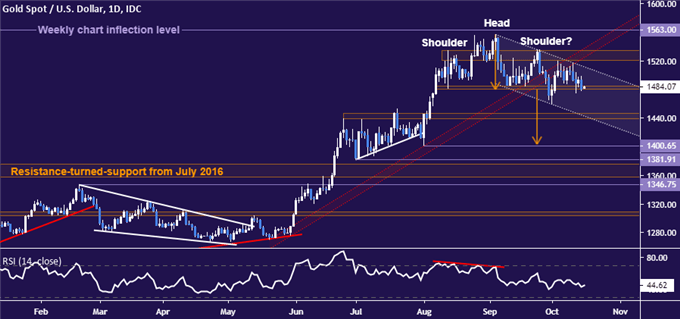

GOLD TECHNICAL ANALYSIS

Gold prices continue to work at making good on a choppy Head and Shoulders topping pattern. Progress has been slow-going but a break of five-month rising trend support bolsters the bearish argument. A daily close below the 1480-84.63 area targets the 1439.14-46.94 zone. Alternatively, a push above the 1520.34-35.03 region targets the weekly chart inflection point at 1563.00.

Gold price chart created using TradingView

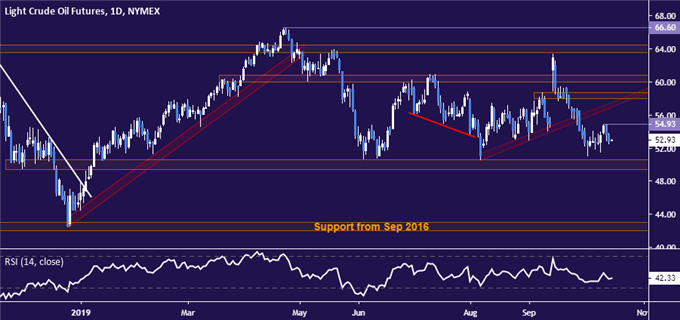

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices continue to mark time above range support in the 49.41-50.60 area. Breaking below that on a daily closing basis exposes three-year lows in the 42.00-43.00 zone. Alternatively, a push above the October 11 high at 54.93 targets a cluster of back-to-back resistance levels running up through 60.84.

Crude oil price chart created using TradingView

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your commodity market questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter