Crude oil, gold price performance chart created using TradingView

CRUDE OIL & GOLD TALKING POINTS:

- Key commodity prices marking time as all eyes turn to Jackson Hole

- Fed Chair Powell may pour cold water on Fed rate cut speculation

- Crude oil prices at risk, gold may not capitalize as sentiment sours

A week of quiet standstill in benchmark commodity prices may end in fireworks as all eyes turn to the Fed’s economic symposium in Jackson Hole, Wyoming. The gathering has served as a launchpad for major policy initiatives by global central banks before, and markets appear primed for another key inflection point.

At issue is the gaping disparity between the outlook favored by the FOMC and the one envisioned by investors. The rate-setting committee has called its July rate cut a “mid-cycle adjustment”, guiding markets away from expectations of a lasting easing cycle. Traders bet on 50-75bps in further cuts all the same.

The markets are begging for a counterweight to headwinds from slowing global growth, the US-China trade war and a myriad of political flashpoints, such as Brexit. Meanwhile, the Fed is seemingly struggling to reconcile cuts with its mandate amid solid expansion and low unemployment domestically.

CRUDE OIL, GOLD PRICES MAY FALL ON AS POWELL COOLS FED RATE CUT BETS

That probably sets the stage for Fed Chair Powell to invoke “data dependence” as the guiding principle for policy-setting in a much-anticipated speech headlining the symposium. This might pour cold water on hopes for lavish stimulus expansion, souring risk appetite market-wide.

Cycle-sensitive crude oil prices seem likely to face selling pressure in this scenario. Gold prices – which often capitalize in risk-off trade as yields decline – seem unlikely to do so this time considering it is the prospect of higher-than-hoped for borrowing costs that menaces investors. It too looks vulnerable.

Get our free guide to help build confidence in your gold and crude oil trading strategy !

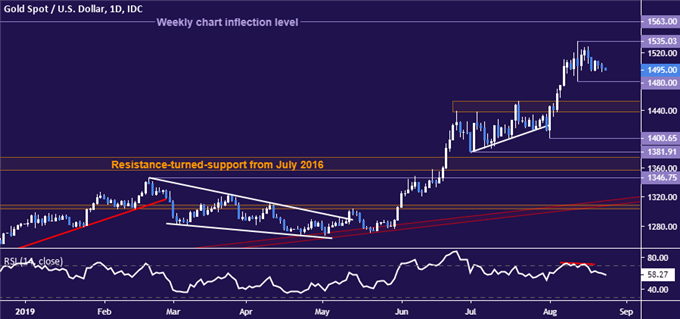

GOLD TECHNICAL ANALYSIS

Gold prices remain locked in a choppy range below August’s high at 1535.03 but negative RSI divergence continues to warn of a top in the works. A daily close under initial support at 1480.00 exposes the 1437.70-52.95 area. Alternatively, a breach of resistance targets 1563.00, a weekly chart price inflection level.

Gold price chart created using TradingView

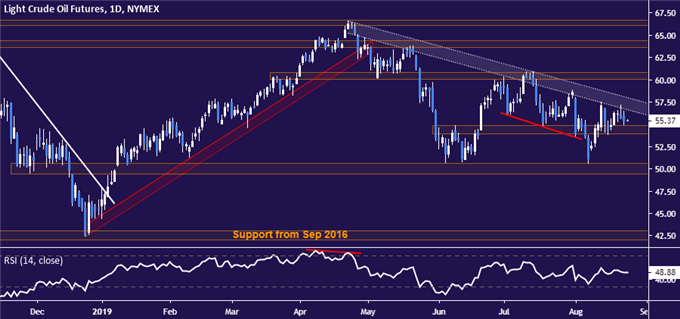

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices remain wedged between falling trend resistance set from late April and the 53.95-54.84 congestion area. A break downward exposes support near the $50/bbl figure once again. A daily close above resistance – now at 58.01 – opens the door to challenge the 60.04-84 zone.

Crude oil price chart created using TradingView

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your commodity market questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter