CRUDE OIL & GOLD TALKING POINTS:

- Crude oil prices may break below support near $50/bbl figure

- Trade war worries may inspire liquidation before the weekend

- Gold price rise may be capped as haven flows lift US Dollar

Benchmark commodity prices idled through a lull in market-moving event risk Thursday, as expected. From here, a broadly defensive mood may prevail in the final hours of the trading week as sentiment trends overshadow a lackluster offering on the economic data docket.

Bellwether S&P 500 futures point sharply lower in late Asia Pacific trade, warning that another risk-off push is ahead. With so much recent volatility linked to ad hoc soundbites from Washington and Beijing amid trade war escalation, it is makes sense that traders may be skittish about holding exposure over the weekend.

Cycle-sensitive crude oil prices look vulnerable against this backdrop. The release of an EIA monthly report that downgrades demand expectations amid global slowdown even as US output remains near record highs might help to compound selling pressure.

Gold prices may get a lift from lower bond yields in this scenario as capital flows to the safety of government bonds. A higher premium on liquidity amid divestment might also buoy the US Dollar, tarnishing the appeal of anti-fiat alternatives and holding back the yellow metal from a more substantive advance.

Get our free guide to help build confidence in your gold and crude oil trading strategy !

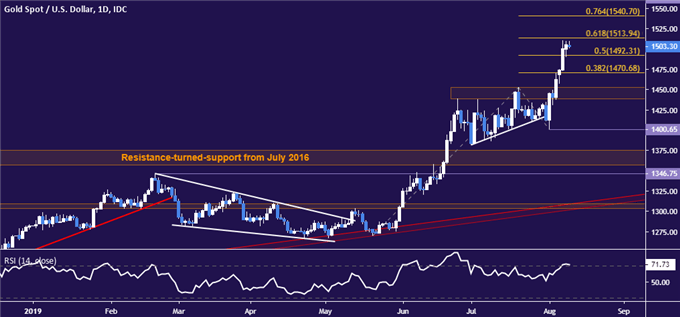

GOLD TECHNICAL ANALYSIS

Gold prices paused to consolidate gains below resistance at 1513.94, the 61.8% Fibonacci expansion. A break above this barrier on a daily closing basis exposes the 76.4% level at 1540.70 next. Alternatively, a reversal lower that brings prices below the 50% Fib at 1492.31 targets the 38.2% expansion at 1470.68 thereafter.

Gold price chart created using TradingView

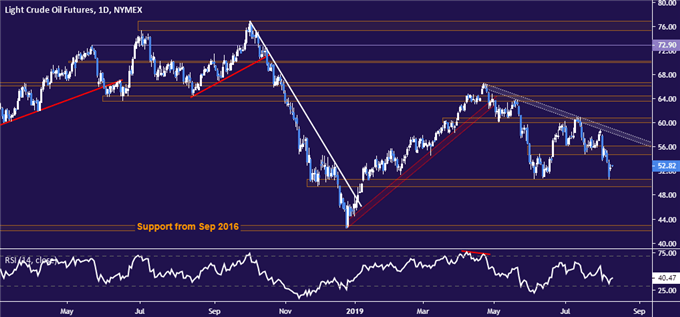

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are testing support 49.41-50.60 area. A daily close below that opens the door to challenge a floor in play since September 2016 in the 42.05-43.00 zone. Alternatively, a turn back above 56.09 aims for back-to-back trend line and congestion region barriers running upward through 60.84.

.

Crude oil price chart created using TradingView

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your commodity market questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter