GOLD & CRUDE OIL TALKING POINTS:

- Gold price chart hints bearish Double Top setup may be taking shape

- Crude oil price recovery rejected at resistance below $56/bbl on WTI

- US PPI and API inventory data, EIA short-term outlook report on tap

Gold prices fell as the US Dollar rose after the Trump administration opted to cancel planned tariffs on imports from Mexico. The move cooled Fed rate cut speculation somewhat, undermining the appeal of anti-fiat alternatives epitomized by the yellow metal.

The news buoyed risk appetite, but typically cycle-sensitive crude oil prices were unable to capitalize. The benchmark WTI contract drifted lower amid reports that Saudi Arabia and Russia are struggling to agree on extending the OPEC+ output cut scheme. Riyadh is on board, but Moscow is unconvinced for now.

GOLD PRICES MAY OVERLOOK US PPI, EIA OUTLOOK AND API INVENTORY DATA DUE

Looking ahead, a relatively quiet economic calendar is headlined by US PPI data. The core wholesale inflation rate is expected to tick lower a bit, from 2.4 to 2.3 percent. A soft result echoing recently downbeat US news-flow might narrowly boost Fed rate cut bets, but scope for follow-through seems limited.

First, the priced-in outlook already envisions a seemingly fanciful scenario wherein the Fed will cut 2-3 times before year-end while also ending quantitative tightening (QT). That seems like an improbably large amount of easing at a time when employment and inflation are broadly near its targets.

Second, traders are probably unwilling to commit to a directional bias based on PPI data when its higher-impact CPI counterpart is due just 24 hours later. With that in mind, a consolidative session may be ahead. Still, kneejerk volatility – courtesy of unexpected US-China trade war headlines, say – remains a risk.

The EIA short-term energy outlook and API oil inventory flow data are also due. The former may speak to the parallel drop in US production capacity and prices since mid-April, which hints at ebbing demand amid global slowdown. The latter will be weighed against forecasts calling for a narrow 961k- barrel outflow.

Did we get it right with our crude oil and gold forecasts? Get them here to find out!

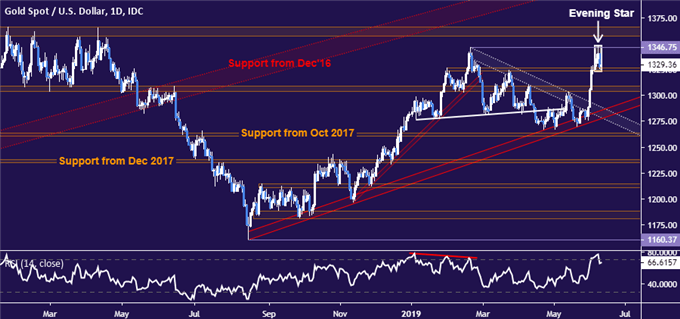

GOLD TECHNICAL ANALYSIS

Gold prices retreated from resistance at 1346.75, the February swing top, and formed a bearish Evening Star candlestick pattern. The setup hints a double top may be in the works. A daily close below support in the 1323.40-26.30 area exposes the 1303.70-09.12 zone. Alternatively, a push through resistance puts trend-defining resistance in the 1357.50-66.06 region back in focus.

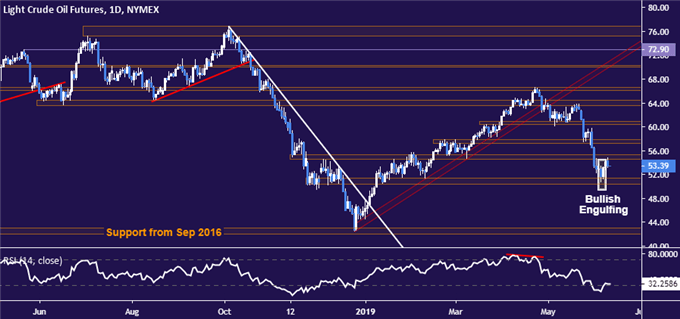

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices probed higher after producing a Bullish Engulfing candlestick pattern as expected but the move hit a wall on a test of support-turned-resistance at 55.75. Turning lower from here eyes initial support in the 50.31-51.33 area, with a daily close below that putting the spotlight on support set from September 2016 in the 42.05-43.00 zone. Alternatively, a breach of 55.75 targets the 57.24-88 zone next.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your commodity market questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter