CRUDE OIL & GOLD TALKING POINTS:

- Crude oil prices rose with stocks as US shelved Mexico import tariffs

- Gold prices down as bond yields, US Dollar advance in risk-on trade

- Sentiment likely to remain in focus, stock index futures point upward

Sentiment-linked crude oil prices gapped higher alongside bellwether S&P 500 futures at the start of the trading week as news that the US has shelved a plan to impose tariffs on imports from Mexico buoyed overall risk appetite. Gold prices fell the upbeat mood cooled Fed rate cut speculation, sending the US Dollar higher alongside bond yields and undercutting the appeal of non-interest-bearing and anti-fiat assets.

CRUDE OIL MAY CONTINUE HIGHER AS GOLD FALLS IN RISK-ON TRADE

Looking ahead, a relatively muted offering on the economic data docket might broad-based trends in the markets’ mood in focus. Futures tracking Wall Street stock benchmark are pointing convincingly higher, hinting that the risk-on tilt may extend from Asia Pacific trade into European and US hours. That might bode ill for gold as crude oil continues to recover.

Did we get it right with our crude oil and gold forecasts? Get them here to find out!

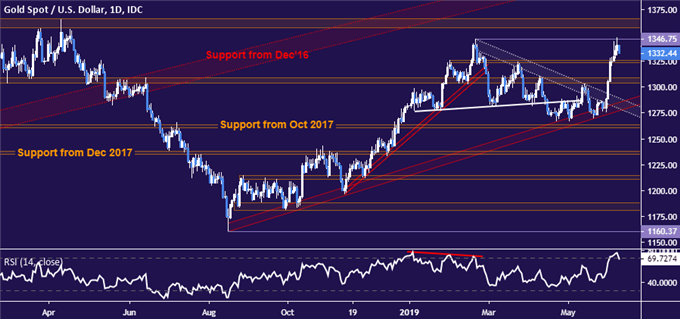

GOLD TECHNICAL ANALYSIS

Gold prices are pulling back from resistance marked by February’s swing high at 1346.75. A turn back below resistance-turned-support at 1323.40 sets the stage for a retest of the 1303.70-09.12 zone. Alternatively, a daily close above resistance targetsa trend-defining barrier in the 1357.50-66.06 area.

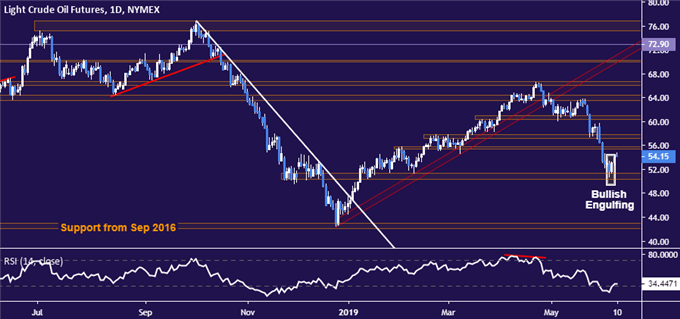

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices rose after forming a Bullish Engulfing candlestick pattern at support in the 50.31-51.33 area, as expected. From here, a daily close above support-turned-resistance at 55.75 targets the 57.24-88 zone next. Alternatively, a reversal below 50.31 opens the door to challenge support set from September 2016 in the 42.05-43.00 region.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your commodity market questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter