TALKING POINTS – YEN, US DOLLAR, STOCKS, GERMAN TRADE, US DATA

- Yen gains, Aussie Dollar leads commodity FX lower in risk-off APAC trade

- Downbeat German, US economic data may stoke global slowdown worries

- JPY gained close to 9% in 2018 as global growth dynamics deteriorated

Financial markets started the trading week in a defensive mood. The sentiment-geared Australian, Canadian and New Zealand Dollars weakened alongside Japan’s benchmark Nikkei 225 stock index and bellwether S&P 500 futures. The anti-risk Japanese Yen and similarly-minded Swiss Franc traded higher.

This may reflect a variety of influences. Two weeks of marathon US-China trade talks ended without a tangible, formal breakthrough. BOJ Governor Kuroda warned that Japanese exports and output will be affected by a global slowdown. A week packed with potent event risk looms ahead.

The US Dollar was unable to leverage this backdrop to attract haven-seeking demand. That might be because Friday’s US jobs report revealed an unexpected drop in wage inflation. Traders may have read this as worthy of a dovish adjustment in Fed policy bets.

GERMAN, US DATA MAY STOKE GLOBAL SLOWDOWN FEARS

Looking ahead, German trade balance data as well as US factory and durable goods orders numbers are due to cross the wires. Soft results echoing the recently disappointing trend in macro news-flow may stoke global slowdown fears, offering fresh fodder for a risk-off pivot.

What are we trading? See the DailyFX team’s top trade ideas for 2019 and find out!

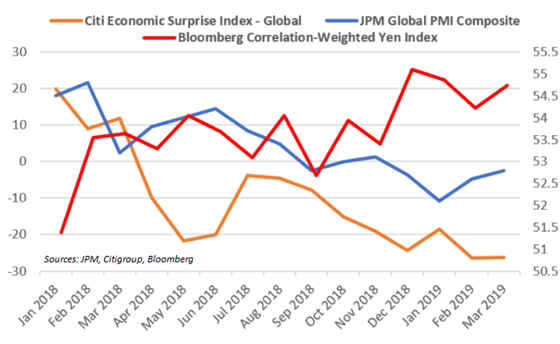

CHART OF THE DAY – YEN GAINS AS GLOBAL ECONOMIC GROWTH COOLS

The Yen often trades higher when risk appetite cools across global financial markets. This speaks to an unwinding of cycle-sensitive carry trade exposure that is often funded in terms of the perennially low-yielding Japanese unit. The recent downshift in the global business cycle seems to be no exception.

The chart above reveals a steady decline in the pace of global economic activity (JPM Global PMI Composite) and an increasingly downbeat tone to incoming data flow (Citi Gobal Econmic Surprise Index) since the beginning of 2018. JPY traded broadly higher against this backdrop, adding 8.8 percent last year.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter