GOLD & CRUDE OIL TALKING POINTS:

- Gold prices drop as bond yields, US Dollar rise in risk-on trade

- Crude oil prices held in place as USD, sentiment influences clash

- Prospects for avoiding second US government shutdown in focus

An upshift in the priced-in 2019 monetary policy outlook implied in Fed Funds futures sent Treasury bond yields higher alongside the US Dollar, sapping the appeal of anti-fiat and non-interest-bearing assets. Gold prices dutifully fell.

Interestingly, stocks rose with rates and the Greenback, implying an earnest improvement in market-wide risk appetite. Optimism emanated from European bourses. Italian banks reassured investors of their ample capital buffers and comments from the Bank of France struck a refreshingly optimistic tone.

Crude oil prices struggled to find lasting direction, ultimately ending the day little-changed. Downward pressure on USD-denominated instruments seemed to be offset by sentiment-driven support for the cycle-sensitive WTI benchmark.

GOLD MAY FALL IF US GOVERNMENT AVOIDS ANOTHER SHUTDOWN

Looking ahead, hopeful headlines hinting the US officials may have struck a deal to avoid another government shutdown may translate into another risk-on session. Indeed, bellwether European and US stock index futures are pointing convincingly higher in late Asia Pacific trade.

If the hopeful tone is sustained as the day progresses, gold might fall further as yields and the Dollar extend upward. The upbeat mood might be challenged by soundbites from a Eurogroup meeting however if policymakers worry aloud about slowing regional growth.

Crude oil may struggle even if sentiment holds up as monthly reports from OPEC and the EIA point to renewed oversupply concerns. API inventory flow data is also due. The outcome will be weighed against forecasts calling for a 1.87-million-barrel build to be reported in official DOE data on Wednesday.

Learn what other traders’ gold buy/sell decisions say about the price trend!

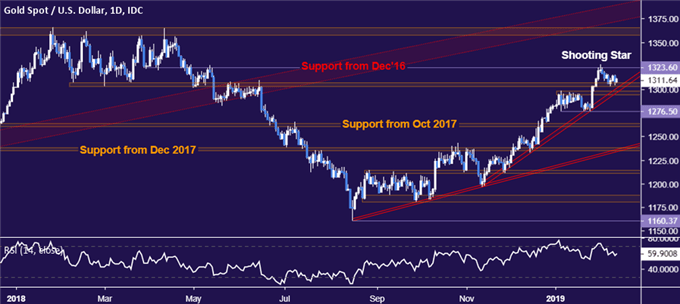

GOLD TECHNICAL ANALYSIS

Gold prices remain stuck above a dense layer of support running through 1294.10. A daily close below that targets 1276.50 next. Alternatively, a move back above chart inflection point resistance at 1323.60 opens the door for a move higher toward key resistance in the 1357.50-66.06 area.

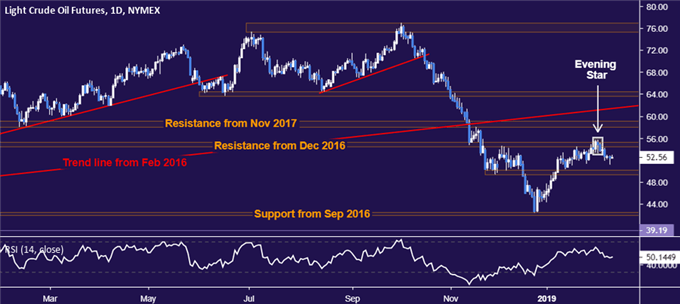

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are digesting losses having turned lower after producing a bearish Evening Star candlestick pattern, as expected. Support is in the 49.41-50.15 area, with a break below that exposing the 42.05-55 zone. Alternatively, a daily close above the February 4 high at 55.75 aims for the 57.96-59.05 region next.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter