GOLD & CRUDE OIL TALKING POINTS:

- Gold prices edge past trend line support, hinting a top is forming

- Crude oil prices rise despite EIA data showing inventories surge

- Swelling risk appetite may hurt gold while crude oil prices rise

A narrow pullback in gold prices kept them confined within familiar trading ranges. The yellow metal may find a bit more scope for directional development in the final hours of the trading week as broad-based market sentiment trends gather momentum.

Risk appetite swelled in APAC trade and bellwether S&P 500 futures are pointing convincingly higher, hinting that more of the same is likely ahead. That might translate into higher bond yields as capital flows out of the safe harbor of government debt, punishing non-interest-bearing assets that gold epitomizes.

CRUDE OIL SHRUGS OFF INVENTORIES SURGE, EYES VENEZUELA

Crude oil price action was a bit more spirited. Prices rose despite EIA inventories data showing stockpiles added a hefty 7.97 million barrels last week, smashing expectations of a slight drawdown. The release was foreshadowed by calls for a 6.55-million-barrel rise from API, which might have defanged it.

The subsequent rally may have reflected pent-up upward pressure waiting to be unleashed by the passage of scheduled event risk (i.e. the EIA report). That might have come courtesy of the turmoil in Venezuela. The country looks to be on the brink of a civil war that might disrupt supply flows.

Further gains may be ahead if the markets’ risk-on disposition is sustained through the rest of the trading day. Indeed, the WTI benchmark tracked higher alongside US stock index futures in Asia Pacific session. As with gold however, the move is yet to extend beyond recently prevailing ranges.

See our guide to learn about the long-term forces driving crude oil prices !

GOLD TECHNICAL ANALYSIS

Gold prices narrowly edged below rising trend line support set from mid-November, hinting that follow-through on the bearish Dark Cloud Cover candlestick pattern identified two week ago may finally be at hand. From here, a daily close below support in the 1260.80-63.76 area exposes the 1235.11-38.00 region. Alternatively, a move back above the trend line – now recast as resistance at 1289.00 – puts the January 4 high at 1298.54 back in focus.

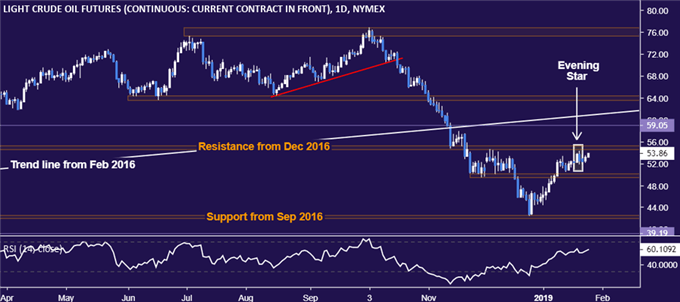

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices continue to oscillate below resistance in the 54.51-55.24 area, but a bearish Evening Star candlestick pattern warns that a top may be taking shape. A drop below support in the 49.41-50.15 area sets the stage for a test of the 42.05-55 zone. Alternatively, a daily close above 55.24 would neutralize near-term bearish cues and open the door to challenge the chart inflection point at 59.05.

COMMODITY TRADING RESOURCES

- Learn what other traders’ gold buy/sell decisions say about the price trend

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter