GOLD & CRUDE OIL TALKING POINTS:

- Crude oil prices erase early gains as White House warns on shutdown impact

- Gold prices rise as fiscal headwind fears sour growth bets, pull down yields

- Stock index futures hint at risk-off bias ahead, OPEC monthly report on tap

Crude oil prices rose alongside stocks as earnings reports from a group of major US banks produced mostly better-than-expected outcomes, with figures from Bank of America and Goldman Sachs looking particularly rosy. Risk-on momentum proved short-lived however as the White House downgraded its forecasts to say that the US government shutdown will cost 0.13 percentage points in quarterly GDP per week.

That news seemed to put a lid on the intraday, with the bellwether S&P 500 stock index rounding a top and drifting down into the close. The WTI contract managed another upside push as EIA inventories produced a larger drawdown than expected but risk-off forces would not be denied, pushing prices off intraday highs alongside the pullback in shares.

The downturn in market sentiment inspired a dovish shift in the priced-in 2019 monetary policy outlook implied in Fed Funds futures. Not surprisingly, that pulled down Treasury bond yields. Gold prices rose in tandem as the downshift in lending rates bolstered the relative appeal of non-interest-bearing assets epitomized by the yellow metal.

GLOBAL SLOWDOWN WORRIES EYED, OPEC MONTHLY REPORT DUE

From here, a dull offering on the data docket will probably see commodity prices continue to reflect uncertainty about the severity of the twin headwinds menacing US economic growth: the government shutdown and the ongoing trade war with China. Wall Street stock index futures are pointing tellingly lower, hinting a risk-off bias that might depress yields and help gold hold up.

Meanwhile, crude oil will be looking to a monthly report form OPECfor an updated set of supply and demand forecasts. The cartel has a habit of putting something of a rosy spin on uptake prospects while downplaying shale-linked oversupply concerns. Markets will thus take notice if the shaky global growth outlook appears to be stoking some unease. This coupled with a broadly risk-off mood may punish prices.

Learn what other traders’ gold buy/sell decisions say about the price trend!

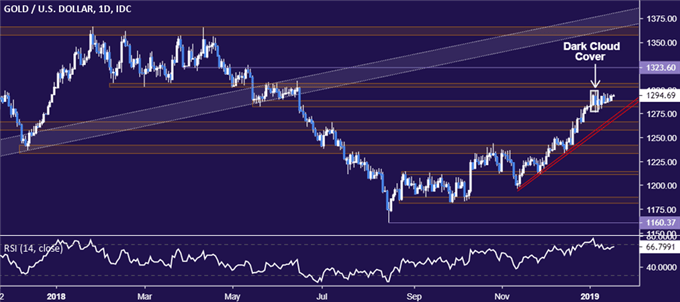

GOLD TECHNICAL ANALYSIS

Gold prices are marking time in a narrow range, but a bearish Dark Cloud Cover candlestick pattern still warns that a top may be taking shape. Breaking initial support at 1282.27 exposes the 1257.60-66.44 area (former resistance, rising trend line). Alternatively, a breach of resistance in the 1302.97-07.32 region opens the door to test a minor barrier at 1323.60, followed by the pivotal top in the 1357.50-66.06 zone.

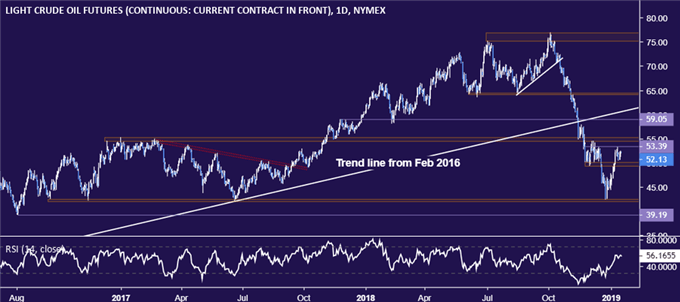

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices continue to consolidate below minor resistance at 53.39. A daily close above this barrier initially targets the 54.51-55.24 area, with a further push beyond that eyeing 59.05. Alternatively, a reversal below the 49.41-50.15 zone sees the next downside hurdle in the 42.05-55 region.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter