GOLD & CRUDE OIL TALKING POINTS:

- Gold prices rise, crude oil prices fall with stocks as Viacom exits China

- Technical positioning still warns that gold prices may be forming a top

- Crude oil price recovery struggling to sustain momentum near $53/bbl

Benchmark commodity prices appeared to reflect inconclusive cues from broad-based market sentiment trends on Friday. Gold prices rose as early risk aversion weighed on bond yields, boosting the appeal of non-interest-bearing assets. A late-day US Dollar bounce in the wake of local CPI data triggered the move’s unwinding, leaving the metal little-changed on the day.

Crude oil prices probed higher but soon fell alongside shares through the risk-off push in the first half of the day. The benchmark WTI contract managed no better than standstill when equities mounted a rebound in Wall Street trade however. Worries about economic headwinds form the US government shutdown seemed linked to early selling but stock traders were perhaps unwilling to carry exposure over the weekend.

VIACOM CHINA EXIT SOURS SENTIMENT, BOOSTS GOLD AS OIL FALLS

Looking ahead, another bout of risk aversion may prove to be decisive for near-term price action. Shares are trading sharply lower in Asia Pacific trade following news that Viacom is divesting from its operations in China. That has sent local shares steeply lower, with Tencent – a local partner for Viacom – leading the decline. S&P 500 futures and crude oil are down in tandem and gold is up as yields retreat.

A dull offering on the economic calendar suggests established momentum faces relatively few hurdles to continuation, hinting at more of the same through the rest of the trading day. Any stray headlines informing investors on progress toward ending the US government shutdown or de-escalating the US-China trade war might alter the prevailing market mood however.

Learn what other traders’ gold buy/sell decisions say about the price trend!

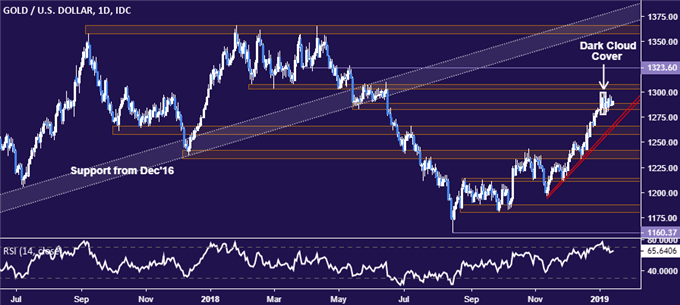

GOLD TECHNICAL ANALYSIS

Gold prices have stalled but the appearance of a bearish Dark Cloud Cover candlestick pattern continues to suggest a top may be taking shape. A daily close below initial support at 1282.27 targets the 1257.60-66.44 area (former resistance, rising trend line). Alternatively, a breach above the 1302.97-07.32 zone would expose a minor barrier at 1323.60, followed by a trend-defining top in the 1357.50-66.06 region.

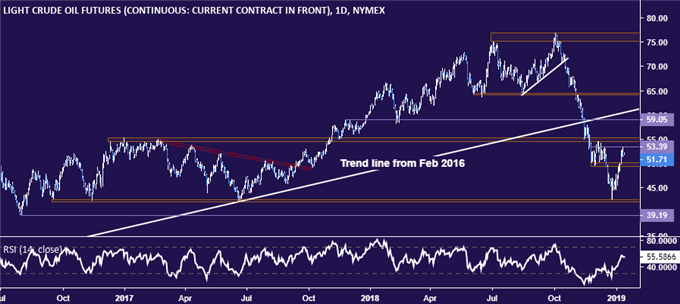

CRUDE OIL TECHNICAL ANALYSIS

The rebound in crude oil prices paused below minor resistance at 53.39. This barrier is followed by a more substantive hurdle in the 54.51-55.24 area, with a daily close above that exposing 59.05. Alternatively, a turn back below resistance-turned-support at 49.41 paves the way to revisit the 42.05-55 region.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter