GOLD & CRUDE OIL TALKING POINTS:

- Gold prices rise on dovish FOMC minutes, topping cues still intact

- Crude oil prices break chart resistance, jump to highest in a month

- All eyes now focused on comments from Fed Chair Jerome Powell

Gold prices rose as markets responded to dovish overtones in minutes from December’s FOMC meeting. Treasury bonds and the US Dollar fell in tandem as the priced-in policy outlook implied in Fed Funds futures flattened further. That understandably burnished the appeal of anti-fiat and non-interest-bearing assets epitomized by the yellow metal.

Crude oil prices likewise rose. Improving risk appetite and a weaker greenback handed the benchmark WTI contract its seventh consecutive daily advance, driving it to the highest level in a month. In fact, prices held up despite a late-day pullback in the bellwether S&P 500 index. EIA inventory flow data registered broadly in line with expectations, showing stockpiles shed 1.7 million barrels last week.

GOLD, CRUDE OIL PRICES SET SIGHTS ON POWELL SPEECH

Looking ahead, US monetary policy bets are likely to remain in focus as comments from Fed Chair Jerome Powell cross the wires. He will have an opportunity to fine-tune market expectations further. Scope for a dovish surprise may be limited considering forecast shift in that direction already baked into asset prices. A finer balance in the rhetoric might trigger seesaw volatility however, hurting gold and crude oil alike.

Learn what other traders’ gold buy/sell decisions say about the price trend!

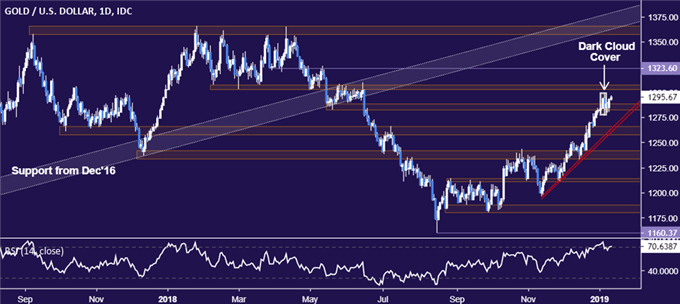

GOLD TECHNICAL ANALYSIS

Gold prices rose within the bounds of their near-term range, but topping cues implied in a bearish Dark Cloud Cover candlestick pattern are yet to be negated. Reversing lower form here sees initial support at 1282.27, with a daily close below that targeting the 1257.60-66.44 area (former resistance, rising trend line). Alternatively, a push above the 1302.97-07.32 zone exposes a minor hurdle at 1323.60, followed by trend-defining barrier in the 1357.50-66.06 region.

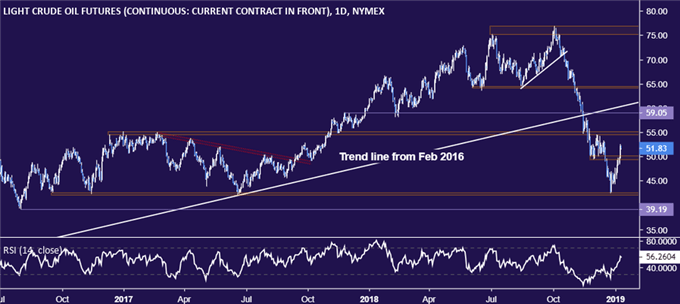

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices punched through resistance in the 49.41-50.15 area to expose the 54.51-55.24 region. A further push beyond that targets 59.05. Alternatively, a turn back below 49.41 opens the door for a retest of the 42.05-55 zone.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter