CRUDE OIL & GOLD TALKING POINTS:

- Crude oil prices seesaw, echoing swings in US stocks

- Gold prices eek out gain as yields fall in risk-off trade

- S&P 500 futures hint sentiment likely to sour further

Sentiment-linked crude oil prices rose alongside gains on Wall Street yesterday. US stocks rebounded in what looked like a corrective move following December’s bloodletting. The bellwether S&P 500 equities index suffered the biggest drop since January 2009, shedding 9.18 percent.

Reports showing that OPEC output plunged by the most in two years in December – before a new cartel-led production cut regime kicked in at the turn of the calendar to 2019 – probably helped drive gains. Much of the advance evaporated intraday however as worrying news from Apple Inc soured sentiment anew.

Gold prices gyrated but ultimately managed to secure a modest gain on the day as the late bout of risk aversion weighed on the priced-in Fed tightening bets, pushing down bond yields. That helped the relative appeal of non-interest-bearing alternatives. At this point, the markets expect no further rate hikes in 2019.

CRUDE OIL MAY FALL IN RISK-OFF TRADE, GOLD EYES US DOLLAR

Looking ahead, US stock index futures are pointing sharply lower to suggest a risk-off bias is likely to prevail in the hours ahead. That bodes ill for oil prices but might keep gold well supported. The yellow metal might find the way forward challenging if the US Dollar recaptures haven demand however.

On the data front, the manufacturing ISM surveyis expected to show US factory-sector activity growth slowed in December, dropping to the bottom of the range prevailing since mid-2017. An outcome echoing a string of data disappointments since mid-November may add compound the markets’ dour mood.

See our guide to learn about the long-term forces driving crude oil prices !

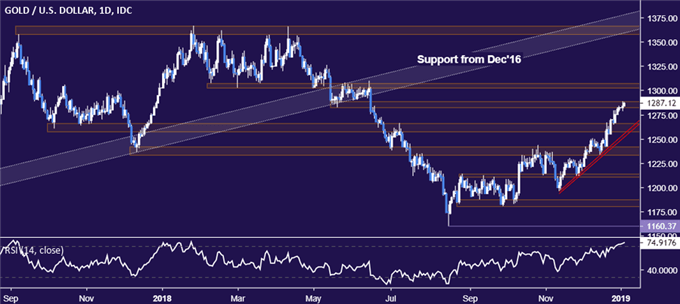

GOLD TECHNICAL ANALYSIS

Gold prices are testing resistance in the 1282.27-88.85 area. A daily close above that opens the door for a challenge of the 1302.97-07.32 zone. Alternatively, a reversal back below rising trend line support at 1252.52 exposes the 1233.60-41.80 region next.

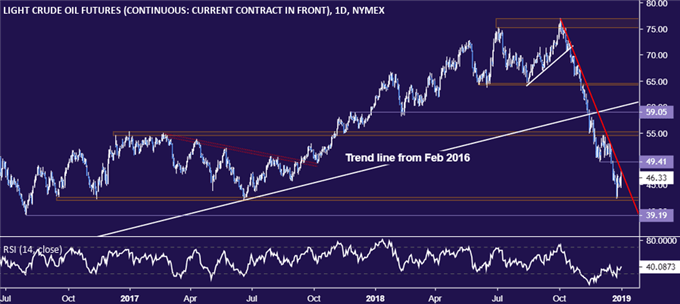

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are testing falling trend line resistance guiding them lower since early October. A daily close above this barrier, now at 47.20, paves the way for a retest of the November 29 low at 49.41. Support lines up in the 42.05-55 area, with a breach below that aiming for the August 2016 low at 39.19.

COMMODITY TRADING RESOURCES

- Learn what other traders’ gold buy/sell decisions say about the price trend

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter