CRUDE OIL & GOLD TALKING POINTS:

- US, Canada and Mexico reach last-minute deal on NAFTA renegotiation

- Crude oil prices aim at 2018 high amid swelling market-wide risk appetite

- Gold prices may resume descent as rising bond yields undermine appeal

Quarter-end capital flows seemed to account for Friday’s moves in key commodities. An upturn in sentiment-geared assets saw crude oil pricesmarching higher alongside the bellwether S&P 500 stock index. Meanwhile, a pullback in the US Dollar helped buoy gold prices, although the benchmark currency still finished the day with a narrow gain as buyers continued to revel the aftermath of the FOMC rate decision.

CRUDE OIL AIMS HIGHER, GOLD AT RISK AFTER NAFTA DEAL

Looking ahead, an eleventh-hour NAFTA renegotiation deal between the US, Canada and Mexico is likely to dominate the spotlight. The new framework – renamed the “US-Mexico-Canada Agreement” or USMCA – ends over a year of contentious talks. A joint statement from US and Canadian officials described it as a “playbook for future trade deals”.

Importantly, the pact still needs to be signed by the three countries’ leaders and ratified by their legislatures. In the case of the United States, that will almost certainly follow midterm elections in November that might significantly alter the makeup of one or both houses of Congress. How that might impact the deal’s chances of implementation is as-yet unclear.

Still, the apparent end of hostilities on at least one front in the US-led global trade war has understandably lifted the markets’ spirits. Shares rose in Asia Pacific trade and US stock index futures are pointing sharply higher. That has scope to weigh on gold as bond yields rise, sapping the appeal of non-interest-bearing alternatives. Crude oil will probably remain well-supported in the meanwhile.

See our guide to learn about the long-term forces driving crude oil prices !

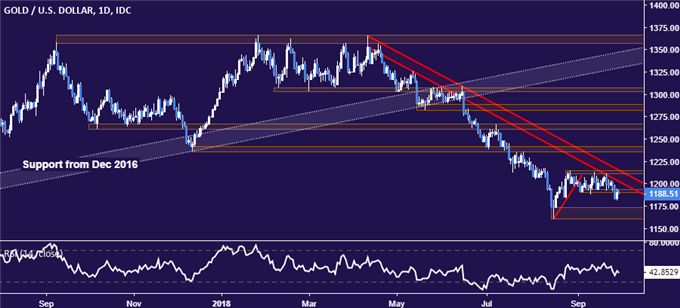

GOLD TECHNICAL ANALYSIS

Gold prices retraced higher to retest former range support in the 1189.76-1193.60 area, which conspicuously held as new resistance. Downward resumption from here sees the next downside barrier in the 1160.37-73.23 area, with a breach of that that exposing the December 2016 swing low at 1122.81. Alternatively, a daily close back above 1193.60 area clears the way for a test of downtrend resistance currently capped at 1215.65.

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices look poised to challenge critical resistance in the 75.00-77.31 area, a region marked by the former support at swing lows recorded between August 2011 and June 2012. A push above that paves the way to probe above the $80/bbl figure. The chart inflection point at 72.88 has been recast as support, with a move back below that opening the door for a retest of the 70.15-41 zone.

COMMODITY TRADING RESOURCES

- Learn what other traders’ gold buy/sell decisions say about the price trend

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter