CRUDE OIL & GOLD TALKING POINTS:

- Crude oil and gold prices marked time amid Labor Day market closures

- ISM data, risk rebound may help commodities on the US Dollar pullback

- Follow-through unlikely as trade war and emerging market risks remain

Commodity prices marked time Monday as market closures in the US and Canada sapped liquidity and undermined directional conviction.Crude oil and gold prices managed narrow gains in what looked like a retracement of prior sentiment-driven losses but near-term trading ranges remained firmly intact.

CRUDE OIL, GOLD MAY RISE AS US DOLLAR RETRACES

Looking ahead, the US manufacturing ISM survey is in focus. The pace of factory sector growth is expected to have slowed for a second consecutive month in August. A downside surprise may yet be in the cards if the release echoes recent deterioration in realized data outcomes relative to forecasts.

That might weigh cool Fed rate hike bets to some extent, weighing on the US Dollar and helping commodities priced in terms of the benchmark currency by extension. A pickup in risk appetite might help. S&P 500 futures are pointing higher, hinting the greenback may shed some recent haven-linked gains.

Follow-through is another matter however. The US unit faces far larger event risk by way of Friday’s labor market data and traders may not show strong directional commitment before it crosses the wires. Furthermore, a risk-off turn as trade war and/or emerging market worries resurface is an ever-present danger.

See our guide to learn about the long-term forces driving crude oil prices !

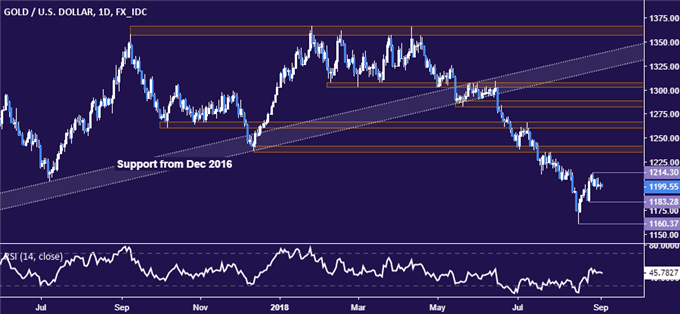

GOLD TECHNICAL ANALYSIS

Gold prices are treading water below the August 28 high at 1214.30. Near-term support is at 1183.28, theAugust 24 low, with break below that exposing the swing bottom at 1160.37. Alternatively, a breach of resistance confirmed on a daily closing basis paves the way for a retest of the 1235.24-41.64 area.

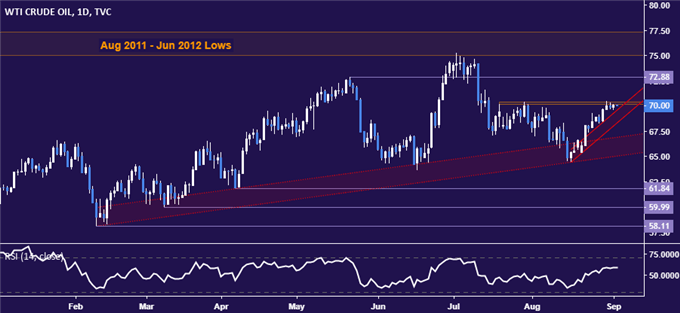

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are stalling ahead of resistance in the 70.15-41 area. A daily close above that exposes the inflection point at 72.88. Alternatively, a break below the outer layer of near-term trend support – now at 68.38 – opens the door for a test of a longer-term uptrend boundary in the 65.08-66.97 zone.

COMMODITY TRADING RESOURCES

- Learn what other traders’ gold buy/sell decisions say about the price trend

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter