GOLD & CRUDE OIL TALKING POINTS:

- Commodity prices drop as US Dollar gains before Jackson Hole symposium

- Gold prices retreat from resistance, crude oil rally stalls at former support

- Hawkish Fed Chair Powell speech may keep raw materials under pressure

Commodity prices turned lower Thursday following the prior sessions’ gains as a recovery in the US Dollar pressured assets denominated in terms of the benchmark unit (as expected). Perennially anti-fiat gold prices appeared to reflect the currency’s recovery most directly while crude oil prices merely stalled having scored the largest daily gain in 2 months Wednesday.

GOLD, CRUDE OIL PRICES AT RISK ON HAWKISH POWELL SPEECH

The greenback advanced alongside two-year Treasury bond yields as the priced-in 2018 interest rate hike path implied in Fed Funds futures steepened. The move probably marks pre-positioning ahead of a much-anticipated speech from Fed Chair Jerome Powell at the central bank’s Economic Symposium in Jackson Hole, Wyoming on Friday.

The annual gathering is often used to unveil guidance signaling the direction of policy in the subsequent months. Mr Powell is likely to use the occasion to reiterate that the Fed intends to proceed with gradual interest rate hikes despite admonitions from President Donald Trump and potentially destabilizing spillover beyond US borders.

Familiar worries about trade wars, emerging market jitters and a likely growth slowdown in the second half of the year will probably re-emerge, echoing minutes from Augusts’ FOMC meeting published earlier this week. Articulating policymakers’ commitment to tightening despite these headwinds may continue to drive commodities lower as the Dollar extends gains.

Learn what other traders’ gold buy/sell decisions say about the price trend!

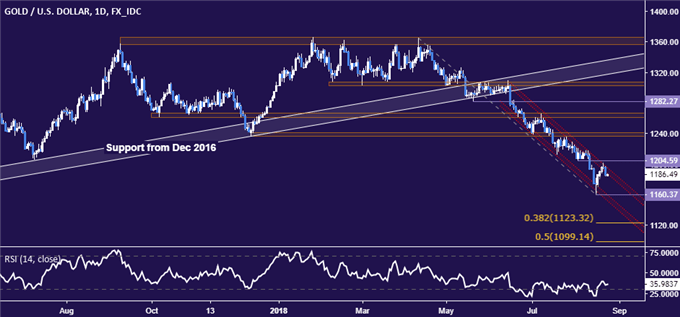

GOLD TECHNICAL ANALYSIS

Gold prices retreated from resistance defining the down trend started in mid-June. Support begins at 1160.37, the August 16 low, with a daily close below that targeting the 38.2% Fibonacci expansion at 1127.93. Alternatively, a rebound and breach above support-turned-resistance at 1204.59 targets the 1236.66-40.86 area.

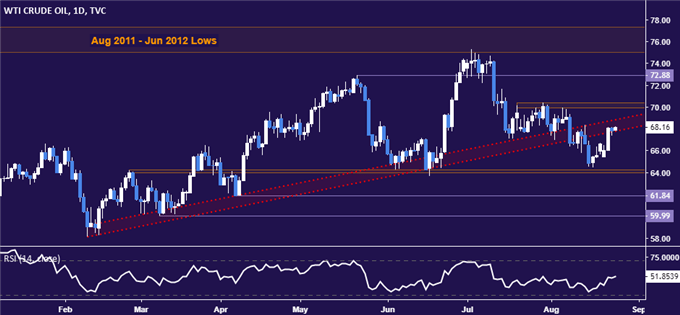

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices stalled at support-turned-resistance guiding the uptrend from February. A daily close above its outer boundary – now at 68.90 – exposes the 69.89-70.41 area next. Alternatively, a push below support in the 63.96-64.26 zone opens the way for a challenge of swing low support at 61.84.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter