CRUDE OIL & GOLD TALKING POINTS:

- Crude oil prices fall as Trump woos Iran, Russia boosts output

- Deeper losses likely if EIA inventory data echoes API estimate

- Gold prices may lead commodities lower on hawkish Fed tone

Crude oil prices fell as easing OPEC+ output caps allowed Russia to increase output to 11.22 million barrels per day and US President Trump said he is prepared to meet with Iranian leader Hassan Rouhani “without preconditions”. That stoked hopes for an accord that might lead to the easing of recently re-imposed sanctions following a US exit from an Obama-era denuclearization deal.

API inventory flow data compounded downside pressure. The report showed stockpiles added a hefty 5.59 million barrels last week. The outcome stands in stark contrast to forecasts calling for a 2.26 million barrel outflow to be reported in official EIA figures due Wednesday. Prices may suffer deeper losses if that result hews closer to the API projection.

See our guide to learn about the long-term forces driving crude oil prices !

HAWKISH FED MAY BROADLY WEIGH ON COMMODITY PRICES

A stronger US Dollar in the wake of the upcoming Fed monetary policy announcement may compound the down move, applying pressure across the spectrum of commodities denominated in terms of the benchmark currency. It may be gold prices that suffer particularly steep losses in such a scenario however if officials dial up hawkish rhetoric, acting directly against the metal’s appeal as an anti-fiat alternative.

Learn what other traders’ gold buy/sell decisions say about the price trend!

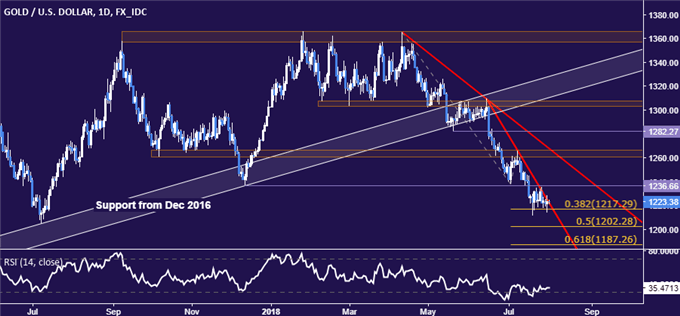

GOLD TECHNICAL ANALYSIS

Gold prices continue to oscillate in a choppy range above the 38.2% Fibonacci expansionat 1217.29. Breaking below this barrier on a daily closing basis targets the 50% levelat 1202.28. Alternatively, a bounce back above support-turned-resistance at 1236.66 paves the way for another test of the 1260.80-66.44 area.

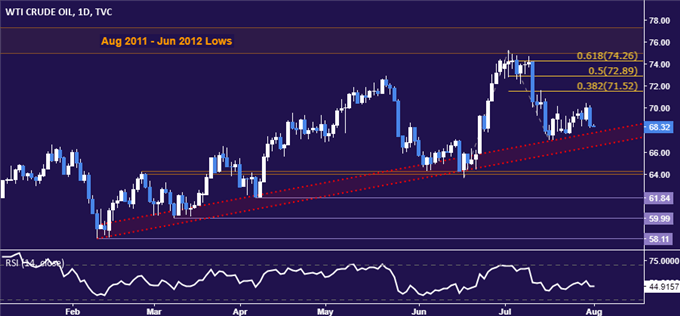

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices slumped back toward support guiding the uptrend since early February, now at 66.53. A daily close below that exposes the 63.96-64.26 zone. Alternatively, a push above the 38.2% Fibonacci expansion at 71.52 aims for the 50% level at 72.89 next.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter