GOLD & CRUDE OIL TALKING POINTS:

- Gold prices may rise as Trump, Junker strike deal on auto tariffs

- Crude oil prices rise on EIA demand outlook, API inventory data

- Chart positioning sees gold, crude oil struggling to find direction

Gold prices made little headway yesterday. A narrow pullback in the US Dollar offered support to the benchmark anti-fiat asset early in the session but follow-through proved lacking, with traders seemingly unwilling to commit ahead of incoming event risk. The spotlight is on a meeting between US President Donald Trump and EC President Jean-Claude Junker in the day ahead.

Mr Junker arrives at the White House on a mission to dissuade Mr Trump from moving forward with proposed tariffs on auto imports. US Department of Commerce hearings showed the duties are deeply unpopular domestically last week, hinting the President may be keen to scrap them. If Junker is able to capitalize on this and cobble together an accord, rising bond yields may hurt the yellow metal as risk appetite firms.

CRUDE OIL PRICES MAY RISE AS US INVENTORIES DROP

Crude oil pricesedged up as the EIA predicted rising demand from China, India and Africa through 2040 in its International Energy Outlook report while API data showed US stockpiles fell last week. The private-sector estimate saw 3.16 million barrel outflow from crude storage. Gasoline and distillate stocks shed 4.87 million and 1.32 million barrels respectively.

Official DOE inventory statistics due to cross the wires today are expected to produce more modest results. Economists envision drawdowns of 2.2 and 1.2 million barrels from crude and gasoline storage respectively while distillate stocks post a modest gain. Outcomes closer to the API projection may offer prices a further boost. A risk-on lead from the Trump/Junker meeting may add to upward pressure.

Learn what other traders’ gold buy/sell decisions say about the price trend!

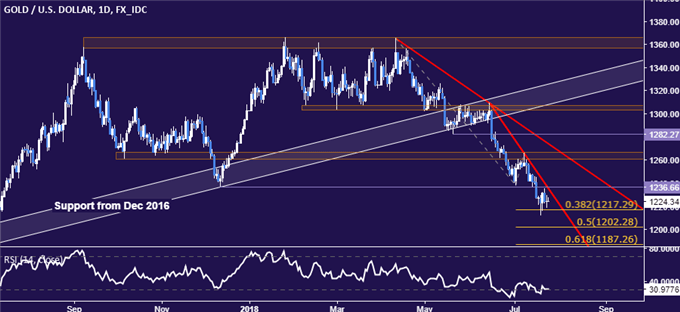

GOLD TECHNICAL ANALYSIS

Gold prices remained pinned to support marked by 38.2% Fibonacci expansion at 1217.29. A daily close below it initially targets the 50% Fib at 1202.28. Alternatively, rebound above support-turned-resistance at 1236.66 paves the way for another challenge of the 1260.80-66.44 area.

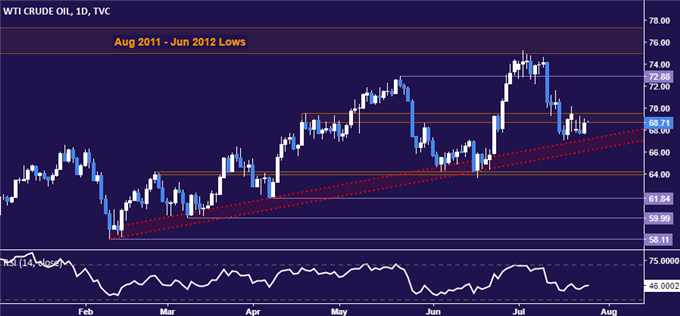

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices continue to tread water near support set from early February, now at 66.17. A break below this barrier exposes the 63.96-64.26 area. Alternatively, a daily close above the 68.74-69.53 zone opens the door for a test back above $72/bbl figure.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter