CRUDE OIL & GOLD TALKING POINTS:

- Crude oil prices seesaw on Saudi Arabia output claims

- Gold prices find support as Trump talks down US Dollar

- Risk aversion may hurt oil, boost gold as yields decline

Crude oil prices seesawed yesterday. Early selling pressure seemingly driven by a stronger US Dollar was erased after Saudi Arabia said exports will drop by 100k barrels per day in August and dismissed oversupply concerns triggered after production rose by the most in three years last month. The move higher unraveled by day’s end however, ultimately leaving the WTI benchmark little-changed.

Gold prices were also on the defensive as an initially stronger greenback undermined the appeal of the standby anti-fiat asset. Most of its downswing evaporated as comments from President Donald Trump pushed the US unit away from intraday highs. He said he was “not thrilled” about Fed interest rate hikes, adding that a strengthening currency puts the US at a disadvantage.

CRUDE OIL MAY FALL AS GOLD GAINS AMID RISK AVERSION

Looking ahead, Baker Hughes rig count data as well as ICE and CFTC futures speculative positioning statistics are unlikely to offer a significant lead for oil prices. An otherwise quiet economic data docket may leave sentiment trends in the spotlight. S&P 500 futures are pointing lower, hinting at an emerging risk-off mood. That may nudge gold higher as bond yields decline while crude falls with other risk-geared assets.

See our guide to learn about the long-term forces driving crude oil prices !

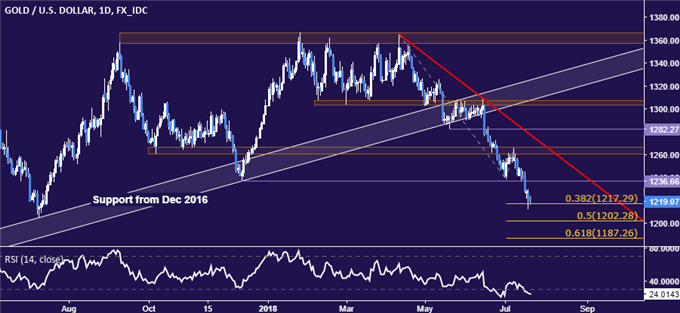

GOLD TECHNICAL ANALYSIS

Gold prices are probing below the 38.2% Fibonacci expansion at 1217.29, with a break confirmed on a daily closing basis exposing the 50% level at 1202.28. Alternatively, a reversal back above support-turned-resistance at 1236.66 paves the way for another challenge of the 1260.80-66.44 area.

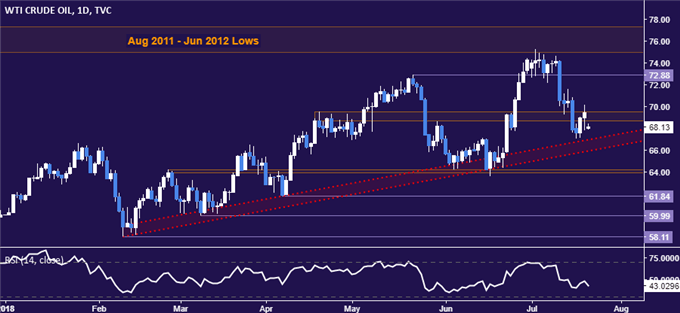

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices continue to hover near rising trend support defining the move higher since early February. A daily close below its lower bound at 65.97 initially exposes the 63.96-64.26 area. Alternatively, a sustained push back above the 68.74-69.53 zone opens the door for a foray back above $72/bbl figure.

COMMODITY TRADING RESOURCES

- Learn what other traders’ gold buy/sell decisions say about the price trend

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter