Talking Points:

- Gold prices grinding at range support as Fed meeting looms ahead

- Crude oil prices eye $64/bbl figure after completing bullish pattern

- JODI data may slow crude advance, gold may delay decisive break

Gold prices edged down as a resurgent US Dollar pushed higher for a second day, sapping demand for the standby anti-fiat alternative. The move appeared to be driven by pre-positioning ahead of the upcoming FOMC policy meeting.Markets seem worried that a recent hawkish shift in officials’ rhetoric means the sit-down will mark acceleration in the Fed rate hike cycle.

Meanwhile, crude oil prices suddenly shot higher in the final hours of the trading week. A clear-cut catalyst for the rally is not readily apparent but ICE speculative positioning statistics may have contributed to upward pressure. They showed that large speculators’ exposure to Brent crude futures has turned the least net-short since early August 2017.

From here, JODI global oil output and exports data headlines an otherwise muted docket of scheduled event risk. The release may slow crude’s near-term advance if the numbers reinforce the sense that higher prices are inviting a self-defeating ramp up of US output. Gold might struggle for follow-through as traders wait for the Fed to say its piece before showing directional commitment.

Find out what retail traders’ bets on gold strength mean for on-coming price moves!

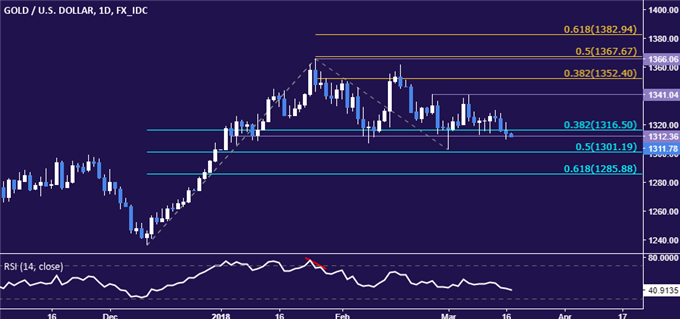

GOLD TECHNICAL ANALYSIS

Gold prices are keeping familiar support in the 1312.36-16.50 area (range floor, 38.2% Fib retracement) under pressure. A break downward confirmed on a daily closing basis sees the next downside barrier at 1301.19, the 50% level. Alternatively, a recovery above the March 14 swing high at 1330.01 targets near-term range resistance at 1341.04.

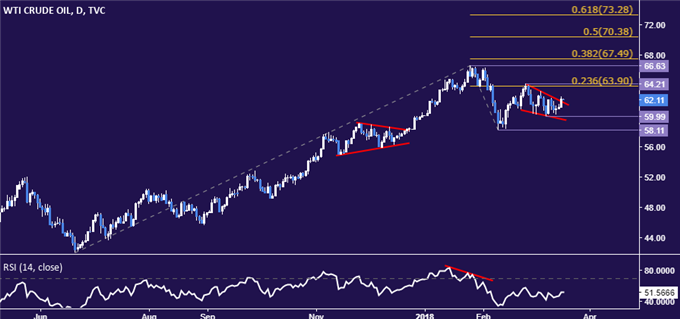

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices broke upward out of a Falling Wedge chart pattern, as expected. Resistance now stands in the 63.90-64.21 area (23.6% Fibonacci expansion, February 26 high), with a daily close above that exposing the 66.63-67.49 zone (January 25 high, 38.2% level). Alternatively, a move back below the wedge top – now recast as support – opens the door for a retest of the $60/bbl figure.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

To receive Ilya's analysis directly via email, please SIGN UP HERE