Talking Points:

- Crude oil prices fail to capitalize on upbeat news, sentiment recovery

- Gold prices resume descent, completing what may be a significant top

- See our guide to learn what are the long-term forces driving crude oil

Crude oil prices languished in digestion mode paying little heed to a recovery in risk appetite and API data saying US inventories shed 1.05 million barrels last week. The Census Bureau also said US oil exports slowed in December. Those supportive developments were countered by an EIA report predicting that US output will rise above 11 million b/d by November 2018, a full year earlier than previously anticipated.

From here, official DOE inventory flow statistics are in focus. An outcome echoing the API projection would mark a significant upside surprise relative to consensus forecasts calling for a build of 3.25 million barrels, and may lead prices higher. S&P 500 futures are pointing cautiously lower however, hinting that a market-wide return to risk-off trade might rekindle selling pressure.

Gold prices turned lower as the rebound in the equities space pulled Treasury bonds upward, undermining the appeal of non-interest-bearing assets including the yellow metal. A steady stream of comments from Fed officials is now in focus. Presidents of the US central bank’s Dallas, New York, Chicago and San Francisco branches are all due to speak over the coming day.

Traders are surely keen to hear what policymakers have to say about tightening prospects in the wake of recent market turmoil. Confidence in a March rate hike has wavered a bit, with the priced-in probability of an increase down to 80.4 percent from 86.7 percent a week ago. If the day’s speakers hint that turbulent asset prices might delay stimulus withdrawal, gold is likely to trade higher.

Find out here what retail traders’ gold trade decisions hint about the price trend!

GOLD TECHNICAL ANALYSIS – Gold prices resumed the push downward as expected, completing what may be a Head and Shoulders (H&S) top. From here, a daily close below the 38.2% Fibonacci retracement at 1316.50 exposes the 50% level at 1301.19. The H&S setup implies a measured downside target below the 1300/oz figure. Alternatively, a push above trend line resistance – now at 1343.48 – paves the way for a retest of the January 25 top at 1366.06.

Chart created using TradingView

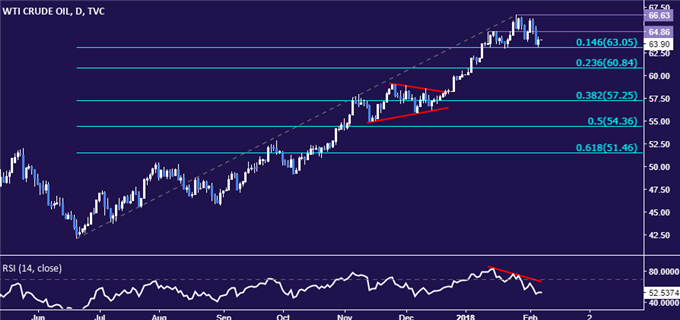

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices continue to oscillate in a choppy range above the $63/bbl figure, but negative RSI divergence still warns of a possible turn downward ahead. A daily close below the 14.6% Fibonacci retracement at 63.05 exposes the 23.6% level at 60.84. Alternatively, a move back above a chart inflection point at 64.86 opens the door for another test of the January 25 high at 66.63.

Chart created using TradingView

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak