Talking Points:

- Crude oil prices aim at November high after belated post-OPEC bounce

- Gold prices back on the defensive after Senate approves tax cut scheme

- Risk-on flows may shape near-term trade unless politics spoil the mood

Crude oil prices found a bit of belated upside momentum after OPEC and like-minded producers agreed to extend a cartel-led output cut regime due to expire in March through the end of next year. The announcement initially failed to spark enthusiasm because the extension was widely expected while the hoped-for announcement of a gradual approach to the scheme’s eventual unwinding didn’t materialize.

Gold price are on the defensive after the US Senate passed a tax cut plan on Friday, marking an important step in realizing an inflationary fiscal program that pressures the Fed into a more aggressive tightening cycle in 2018. The news triggered a steepening of the priced-in rate hike outlook and stoked risk appetite, sending bond yields higher and undermining the appeal of non-interest-bearing assets.

Looking ahead, S&P 500 futures are pointing convincingly higher ahead of the opening bell on Wall Street, hinting that the yellow metal may continue to suffer as lending rates rise in broadly risk-on trade. The chipper mood may be upset by headlines emerging out Washington DC however if testimony from former national security advisor Michael Flynn threatens the Trump administration’s inner circle.

As for oil, a near-term lull in relevant event risk might make for a bit of consolidation before the next major step in trend development. It ought to be kept in mind that the WTI benchmark continues to show a significant positive correlation with the S&P 500 and the broader MSCI World Stock index (0.61 and 0.75 respectively on rolling 20-day studies), so swelling risk appetite may turn out to be supportive.

What are the fundamental forces driving long-term crude oil price trends? See our guide to find out!

GOLD TECHNICAL ANALYSIS – Gold prices are taking aim at support in the 1266.44-69.10 area (October 6 low, 38.2% Fibonacci expansion) once again, with a break confirmed on a daily closing basis exposing the 50% level at 1257.69. Alternatively, a move above channel floor support-turned-resistance at 1281.00 clears the way for a challenge of the 38.2% Fib retracement at 1297.74.

Chart created using TradingView

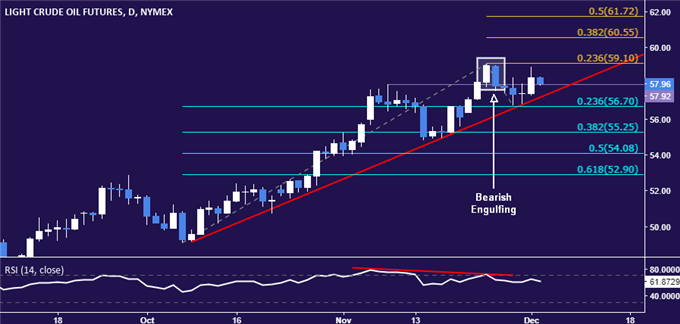

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices reclaimed foothold above 57.92 and look poised to challenge the 23.6% Fibonacci expansion at 59.10 once again. A daily close above that exposes the 38.2% level at 60.55. Alternatively, a move back below 59.10 targets rising trend line support at 57.25, followed by the 23.6% Fib retracement at 56.70.

Chart created using TradingView

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak