Talking Points:

- Gold prices turn lower as Fed rate hike speculation heats up anew

- Crude oil prices remain locked in a narrow consolidation range

- US Presidents Day holiday may mark pause in trend development

Gold prices turned lower on Friday when it became clear that a G20 foreign ministers’ meeting passed without major incident (as expected). The move played out inversely of a rise in the US Dollar and Treasury bond yields as well as a steepening of the priced-in rate hike path implied in Fed Funds futures.

This hints that monetary policy speculation returned to the forefront as geopolitical jitters receded. Not surprisingly, this proved detrimental for the yellow metal considering hawkish comments from Fed Chair Yellen and unexpectedly strong CPI data on offer.

Prices remain on the defensive after upbeat remarks form Cleveland Fed President Loretta Mester offered the greenback a further lift. Follow-through may be muted in the near term however as US markets remain shuttered for the Presidents Day holiday, draining the stock of relevant news-flow.

Crude oil prices remain locked in a narrow range as traders weigh up the influence of OPEC’s output cut scheme against growing swing supply. Indeed, Baker Hughes data showed that the number of US rigs in operation rose to a 16-month high last week. Standstill will probably continue through the holiday lull.

Are gold and crude oil prices matching DailyFX analysts’ first-quarter bets? Find out here !

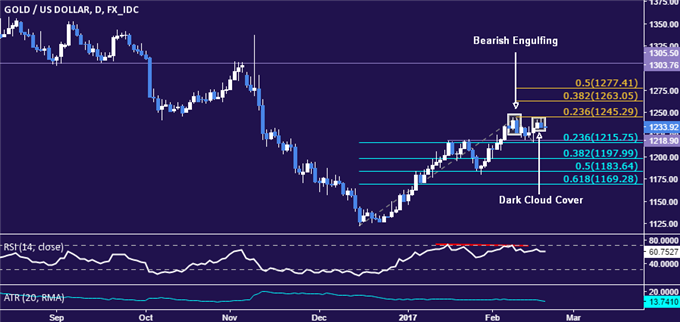

GOLD TECHNICAL ANALYSIS – Gold prices put in a bearish Dark Cloud Cover candlestick pattern after testing now-familiar resistance near February’s swing top. A prior test in the same area produced a still-valid Bearish Engulfing setup. On balance, positioning hints a double top may be in the works. A daily close below the 23.6% Fibonacci retracement at 1215.75 exposes the 38.2% level at 1197.99. Alternatively, a push above the 23.6% Fib expansion at 1245.29 targets 1263.05, the 38.2% threshold.

Chart created using TradingView

CRUDE OIL TECHNICAL ANALYSIS – Crude oil price remain locked in a narrow range. A daily close above its topside boundary at 53.86 exposes the 55.21-65 area (January 3 high, 38.2% Fibonacci expansion). Alternatively, a push below rising trend line support, now at 51.95, targets the 38.2% Fib retracementat 50.25.

Chart created using TradingView

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak