Talking Points:

- Gold prices extend win streak as “Trump trade” unwinding resumes

- US CPI data may reboot Fed rate hike bets, weigh on precious metals

- Crude oil prices mark time, may find renewed momentum in API data

Gold prices accelerated upward, posting the largest advance in two weeks. In a familiar fashion, the metal rose as the US Dollar fell alongside Treasury bond yields, boosting the appeal of anti-fiat and non-interest-bearing assets.

The news-wires were quick to attribute the move to comments from US President-elect Trump, who said the greenback is “too strong” in an interview with the Wall Street Journal. In fact, it started some time earlier and seems to mark the return of “Trump trade” unwinding as the dominant market theme after it had been briefly overshadowed by “hard Brexit” fears at the start of the week.

Looking ahead, December’s US CPI data is in focus. The headline on-year inflation rate is expected to rise to 2.1 percent, the highest since June 2014. US economic data has increasingly outperformed relative to consensus forecasts in recent weeks. A similar upside surprise this time around may echo December’s strong wage growth data, rekindling Fed rate hike speculation and weighing on gold.

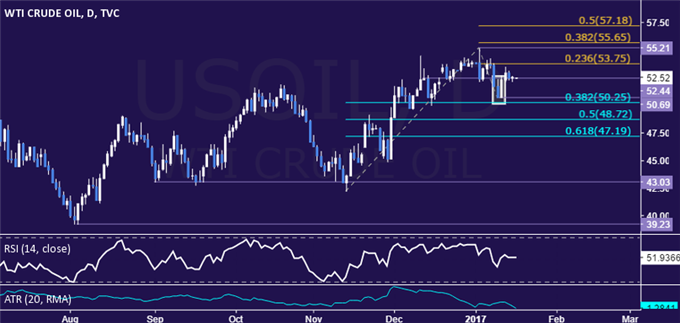

Crude oil prices continue to mark time in familiar territory as markets waited for fresh fodder to drive directional momentum. That may come in the form of weekly API inventories data due later today. Comments from key policymakers and investors at the World Economic Forum ongoing in Davos may also have market-moving potential.

Will gold and crude oil prices continue to rise in the first quarter of 2017? See our forecasts here !

GOLD TECHNICAL ANALYSIS – Gold prices have rallied for a seventh consecutive day, making for the longest winning streak in over two months. From here, a daily close above the 38.2% Fibonacci retracement at 1219.20 exposes the 1248.98-50.65 area (50% level, June 24 low). Alternatively, a reversal below resistance-turned-support at 1199.80 (May 30 low) targets the 23.6% Fib at 1182.36.

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices continue to struggle to build on the promise of a Bullish Engulfing candlestick pattern. A daily close above the 23.6% Fibonacci expansionat 53.75 targets the 55.21-65 area (swing high, 38.2% level). Alternatively, a turn back below resistance-turned-support at 52.44 exposes the 50.25-69 zone (38.2% Fib retracement, January 10 low).

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak