Talking Points:

- Gold prices recoil from two-month trend resistance

- Crude oil prices extend rally on EIA inventory data

- Fed officials’ comments in focus into the week-end

Gold languished in digestion mode amid a lull in Fed-linked event risk yesterday, as expected. Comments from Boston and Dallas Fed Presidents Eric Rosengren and Robert Kaplan may rekindle volatility as traders absorb the last bits of guidance before the pre-FOMC meeting blackout period that begins on Tuesday. Hawkish overtones in line with recent remarks from other US central bank officials may boost rate hike speculation, boosting the US Dollar and weighing on the yellow metal.

Crude oil prices continued to push higher as the official set of EIA inventories report showed stockpiles dropped by a whopping 14.5 million barrels, an outcome that stands in stark contrast with expectations calling for a 631k-barrel build. The outcome was foreshadowed by an estimate from API yesterday. A slowdown in oil-specific news flow puts prices at the mercy of external factor, with the impact of Fed-speak on the trajectory of the greenback lining up as an important consideration. Headline risk related to the upcoming OPEC meeting remains a potential source of volatility as well.

Are retail traders buying or selling gold? Find out here !

GOLD TECHNICAL ANALYSIS – Gold prices corrected gently lower after testing trend line resistance set from early July. Near-term support is at 1333.62, the 23.6% Fibonacci retracement, with push below that targeting the 1303.62-08.00 area (May 2 high, 38.2% level). Alternatively, a breach of trend line resistance (now at 1351.35) on a daily closing basis exposes the 1367.15-69.41 zone (double top, 38.2% Fib expansion).

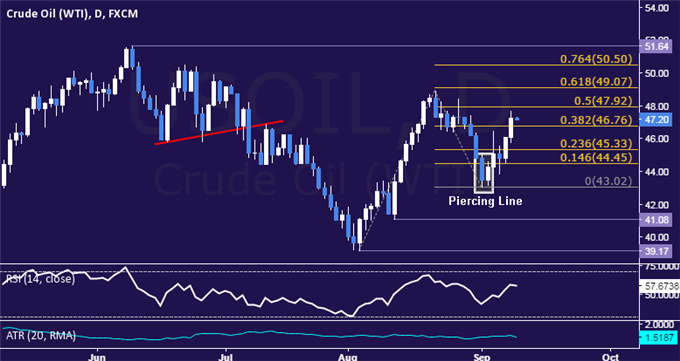

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices advanced to a two-week high having set a bottom as expected after the appearance of a bullish Piercing Line candlestick pattern. Near-term resistance is now at 47.92, the 50%Fibonacci expansion, with a daily close above that targeting the 48.97-49.07 area (August 22 high, 61.8% level). Alternatively, a reversal back below the 38.2% Fib at 46.76 sees the next downside barrier at 45.33, the 23.6%expansion.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak